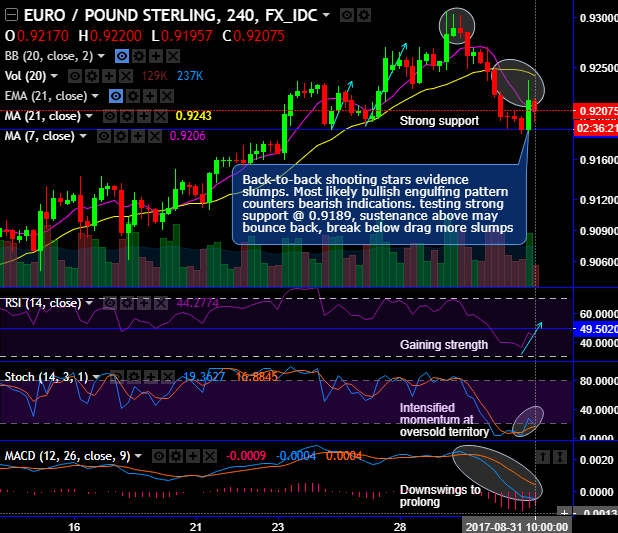

EURGBP rallies for the day seems to be little edgy, restrained below 21DMAs but not exhaustive as it tests strong supports at 0.9189 levels. Consequently, forms both bullish and bearish candlestick patterns such as dragonfly doji and shooting star exactly at this support zone amid the robust bullish trend (refer 4H charts), sustenance above this support level may bounce back, else, break below likely to drag more slumps.

In the recent past, back-to-back shooting stars evidence slumps. For now, the bullish engulfing pattern at 0.9217 levels counters bearish indications to signify the strength in the minor trend.

Momentum and trend study divulge that the trend has been gaining strength in the uptrend while lagging indicators have been bearish bias.

Considering the momentum and trend indicators, one might get puzzled about this stiff tug of war between bulls and bears, but never buck the major trend is the shrewd strategy, and the major trend has been bullish. Thus, accumulate longs capturing every dip makes the portfolio more optimal.

Bullish momentum has been regained upon the formation of resembling 3-white soldiers pattern (refer monthly chart), break-out above stiff resistance 0.9070 to extend more rallies, the current prices are hovering well beyond 7EMAs on this timeframe.

Moreover, we just missed the 3-white soldier pattern which is bullish in nature as spinning top pattern popped up between at 0.8774 levels (refer monthly terms).

RSI and stochastic curves on this time frame evidence upward convergence with the price spikes that signal strength in the uptrend.

MACD – this lagging indicator has signaled the bullish trend to prolong in further.

Trading tips: On speculative as well as hedging grounds, initiate longs in futures contracts of mid-month tenors to arrest the potential upside risks upto 0.9330 levels or more but keep a strict stop loss of 0.9070 levels.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing -43 (which is bearish), while hourly GBP spot index was at 41 (bullish) at 11:52 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: