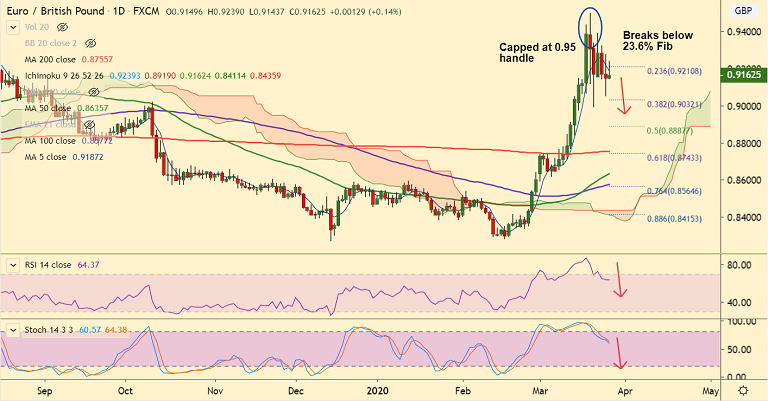

EUR/GBP chart - Trading View

EUR/GBP edges lower from session highs at 0.9239, gradual decline seen as pair eases from overbought levels.

Market focus on the Bank of England (BoE) monetary policy update. The BoE is expected to leave its policy unchanged after two emergency moves.

The central bank slashed rates to 0.25% in the previous week, after which, the bank's lending rate stands at 0.10%.

Its Quantitative Easing program stands at £645 billion – up £200 billion from the previous levels.

The BOE also announced a lending scheme worth around £100 billion, in its first coronavirus emergency decision.

Technicals suggest EUR/GBP is set to extend weakness. 5-DMA is sharply lower and Stochs and RSI have rolled over from overbought levels.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) confirmation on the hourly charts adds to the bearish bias.

Support levels - 0.9032 (38.2% Fib), 0.8967 (21-EMA)

Resistance levels - 0.9185 (5-DMA), 0.9210 (23.6% Fib)

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge