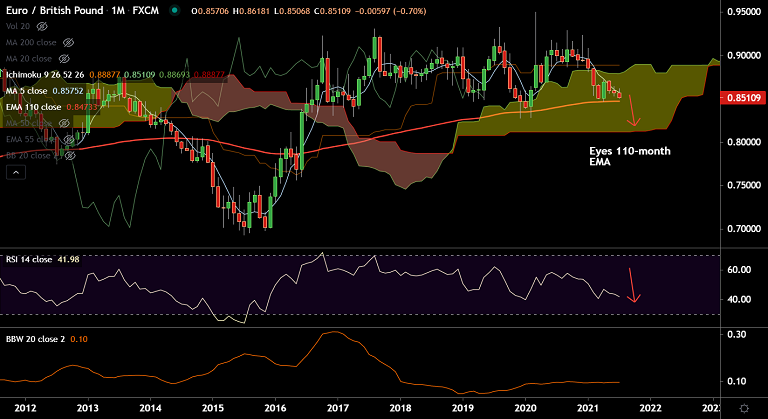

EUR/GBP chart - Trading View

EUR/GBP was trading 0.09% lower on the day at 0.8514 at around 10:10 GMT, after closing 0.16% lower in the previous session.

The pair is extending weakness for the 4th consecutive session. scope for further downside as technical indicators turn bearish.

On the data front, better-than-expected UK CPI figures provided a goodish lift to the British pound.

Data released earlier today by the Office for National Statistics showed UK headline CPI rose 2.5% YoY in June as against consensus estimates at 2.2% and 2.1% previous.

Core CPI jumped to a 2.3% YoY rate during the reported month from 2.0% recorded in May.

Further, eurozone’s Industrial Production showed a bigger-than-expected drop in May, the official data published by Eurostat showed on Wednesday.

Industrial output in the bloc arrived at -1.0% MoM vs. a 0.2% drop expected and 0.6% last.

On an annualized basis, the industrial output jumped by 20.5% in May versus a 22.2% increase expected and April’s 39.4%.

Technical bias for the pair is bearish. Analysis of GMMA indicator shows major and minor trend are bearish.

Recovery attempts were capped at daily cloud. Momentum is strongly bearish and volatility is rising.

EUR/GBP bears eye 110-month EMA support at 0.8473. Break below will drive further weakness.