We've been keenly tracking the short and long term swings of EURGBP in the interest of both bulls and bears.

Exactly 2 and half month ago (on 23rd Mar to be precise), we came up with a technical write up which provided targets upto 0.80.

Thereafter a month later, we again gave a call which provided a caution for the same bulls on April 19th to cover longs on restrained bulls.

We're quite sure you would be convinced if you go through the below links for those historical evidences.

Technical Road map ahead:

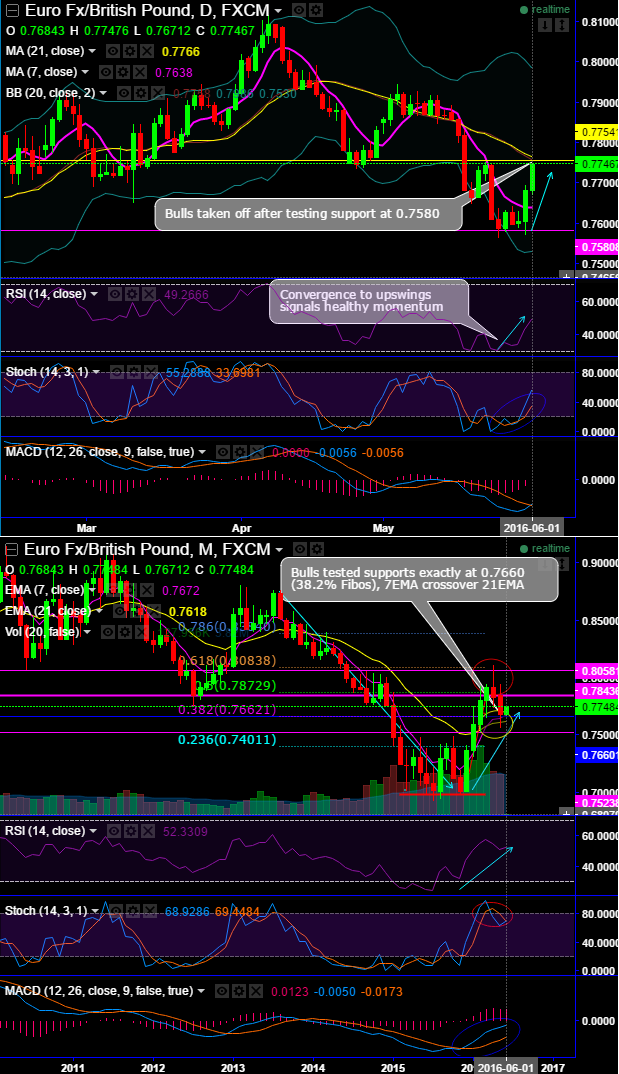

EOD technical charts have shown the price upswings from three consecutive days that evidence bounces above 7DMA.

Bulls taken off after testing support at 0.7580, these bullish candles with big real body along with convergence by leading oscillators to the prevailing upswings signals healthy momentum and the intensity in buying interests.

As the month of deciding Brexit issue that has been lingering from last couple months for lots of speculations began, bulls tested supports exactly at 0.7660 (38.2% Fibos), 7EMA crossover 21EMA.

While leading indicators on monthly have been bullish bias but stochastic still shows indecisiveness near overbought territory.

Although, MACD with bullish crossover remain in bearish zone signal upswing continuation.

On a swing trading perspective, it is smart to buy at dips, we advocate buying binary delta calls for minimum targets of 20-25 pips.