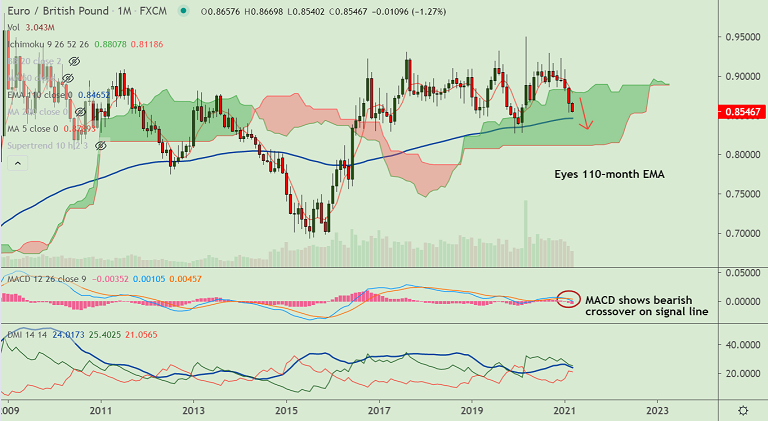

EUR/GBP chart - Trading View

EUR/GBP was trading 0.35% lower on the day at 0.8544 at around 10:45 GMT. Outlook is bearish.

Data released earlier by the Eurostat showed seasonally-adjusted Trade Balance of the euro area declined to +€24.2 billion in January from +€27.5 billion in December.

Details of the report showed euro area January seasonally-adjusted exports decreased by 2.8% and imports by 1.3%.

Meanwhile, the euro area Labor Cost in the fourth quarter rose by 3% following the 1.6% increase recorded in the third quarter.

Focus now on the Bank of England policy meeting due 11:30 GMT. Analysts expect little change from the wait and see approach offered in recent months.

Any hawkish and optimistic tone from the central bank amidst vaccine optimism could buoy the pound across the board.

EUR/GPB trades with a bearish bias. Technical indicators point to further weakness. Scope for test of 110-month EMA at 0.8465.