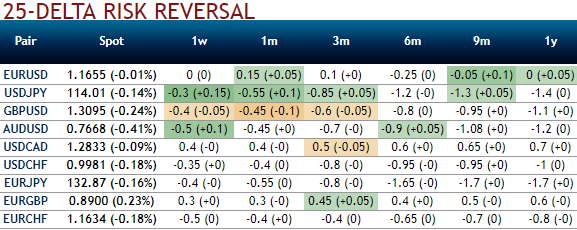

Please be noted that the risk reversals are still indicating bearish risks, while positively skewed IVs of the same tenor signifies the hedgers’ interests in OTM put strikes.

On the flip side, if you look at the technical chart of this pair, the major trend has been rising higher. The technical trend indicators have also been substantiating the continuation in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Fundamentally, the historical experience from valuation frameworks suggests that euro valuations are not yet a constraint for further strengthening. On long-term valuation metrics, even though the euro has strengthened by 15% in TWI terms since the post-QE bottom, historical experience from other major currencies where markets perceived an impending end of QE programs showed a larger, 26% strengthening in TWI on average.

Hence, keeping the both fundamental and technical factors in mind, it is advisable to initiate below relative value trades.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Buy 3M 30D EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 45 levels (which is bullish), while hourly JPY spot index was at shy above -122 (highly bearish) while articulating (at 07:23 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures