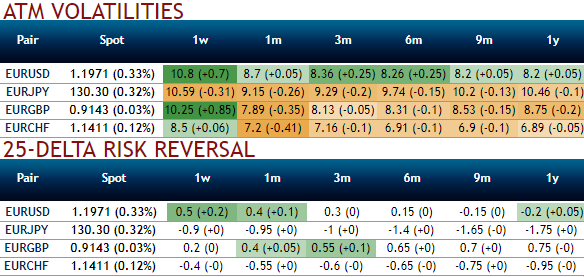

Please be noted that the implied vols of euro crosses have been shrinking lower in spite of the series of data flows are lined up.

German trade balance, French budget and industrial production numbers are due to be announced today.

EUR vols and bearish neutral risk reversals have been shrinking to the lower level. Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, risk reversals have been bearish neutral. While positively skewed IVs towards OTM put strikes signifies hedgers’ bearish sentiments but puzzles prevailing uptrend of euro.

However, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

We advocate maintaining the bullish exposure in EURJPY via a call RKO as JPY weakening is likely to be a slow grind rather than explosive.

Sell 6M EURJPY 25D IVs and risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Vol pts Positive smile theta participation in Euro bull-trend.

The macro theme of euro area leading outperformance remains dominant; maintain core EUR or proxy longs as growth and inflation data continue to be supportive. Accordingly, encourage long EUR vs in cash (vs USD) and through options in EURJPY (130 call, RKO 134).

Any spot holdings, wise to book returns in long EURJPY cash; but stay long EURJPY in options structure.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms