The previous upswings exhausted at the stiff resistance of 123.1715, whipsaws from 8-weeks, the breach below strong support at 121.0887 to drag more price declines.

After inverse saucer on EURJPY, adjoining handle pattern is now on cards as interim bulls seem to be absolutely exhausted at 21EMAs (refer monthly charts).

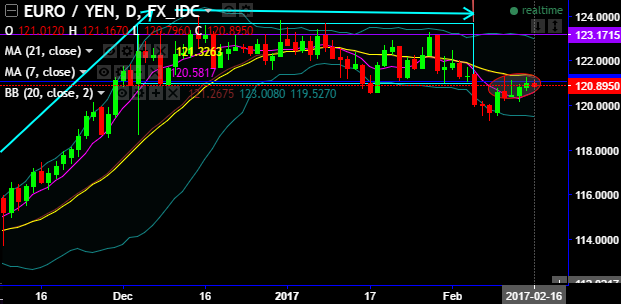

As stated in our recent technical write up on this pair, rallies have extended up to 124 levels or 21-DMA on daily and EMA on monthly plotting. Subsequently, the bear swings seem to be gaining selling interest at this level, that is where attempts of price drops considerable (refer daily chart).

Currently, on weekly plotting, RSI (14) has been converging below 55 levels (while articulating) to the declines that signal the strength in downtrend on both weekly as well as monthly terms, while stochastic curves are also evidencing %D crossover that signal strong selling momentum but this has been little indecisive on monthly terms although bearish biasedness is seen.

Thus, the 6 months of consolidation phase now seems to be deceptive and extension of dips seems most likely as both leading indicators at this juncture indicate shrinking bullish momentum and lagging oscillators have been indecisive but slightly bears favor.

Since the daily price has been stuck in between 7 and 21DMAs from last three days, for intraday trading perspective, it is advisable to buy boundary binaries.

Trading tips:

For intraday trading perspective, at spot reference: 120.8800 levels, it is advisable to buy boundary binaries on dips upper strikes at 121.3250 (21DMA) and lower strikes at 120.5790 (7DMA).

This strategy is likely to fetch leveraged yields than spot FX and certain yields as long as underlying spot FX remains between these two strikes.