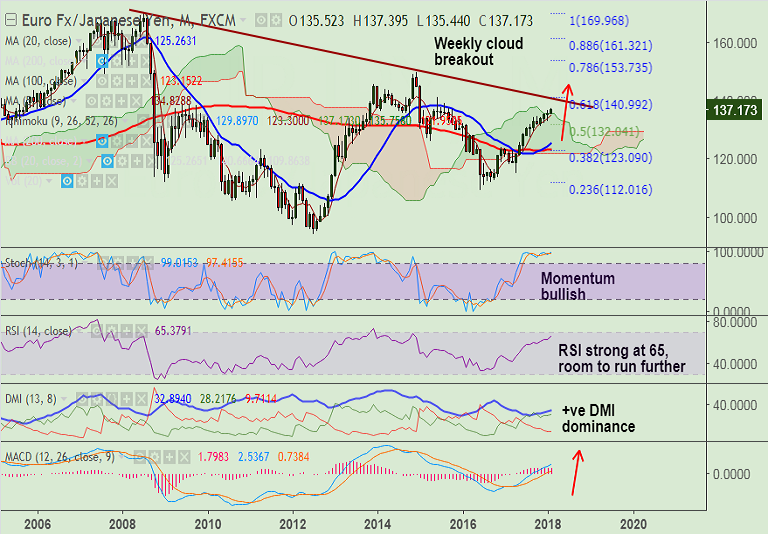

- EUR/JPY has shown a breakout above weekly Ichimoku cloud, we see scope for further upside.

- Technical studies support upside. Momentum studies are bullish. RSI strength seen at 65 levels with room to run further.

- MACD is biased higher, supporting trend higher. We see +ve DMI dominance and ADX also supports current uptrend.

- We see scope for test of 141 levels which is converged trendline and 61.8% Fib retrace of 169.968 to 94.114 fall.

- Breakout at 141 could propel the pair higher. Next bull target above 140 lies at 145.32 (2015 highs).

Support levels - 135.35 (20-DMA), 134 (trendline), 133.55 (100-DMA)

Resistance levels - 139 (Aug 2015 high), 140, 141 (converged trendline and 61.8% Fib retrace of 169.968 to 94.114 fall)

Recommendation: Good to go long on dips around 136, SL: 134, TP: 139/ 141/ 145.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest