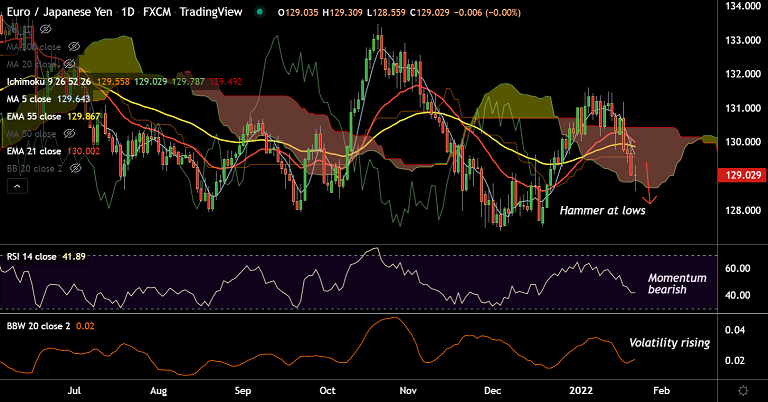

Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.08% higher on the day at 129.13 at around 11:00 GMT.

Previous Week's High/ Low: 131.47/ 129.77

Previous Session's High/ Low: 130.08/ 129.01

Fundamental Overview:

On the data front, focus is on eurozone Consumer Confidence for the month of January along with speeches by ECB Board member Fernandez-Bollo and Chairwoman Lagarde.

Price action is likely to be overall consolidative amidst alternating risk appetite trends in global markets.

Technical Analysis:

- EUR/JPY extends weakness for the 2nd straight week

- Price action plunges further into the weekly cloud

- Momentum is bearish on the daily charts

- GMMA indicator shows major and minor trend are bullish

Major Support and Resistance Levels:

Support - 127.43 (110-week EMA), Resistance - 129.66 (5-DMA)

Summary: EUR/JPY was trading with a strong bearish bias. Volatility is high, momentum is bearish, further drag lower likely. Hammer likely to cushion downside for now. Bearish invalidation only above 21-EMA.