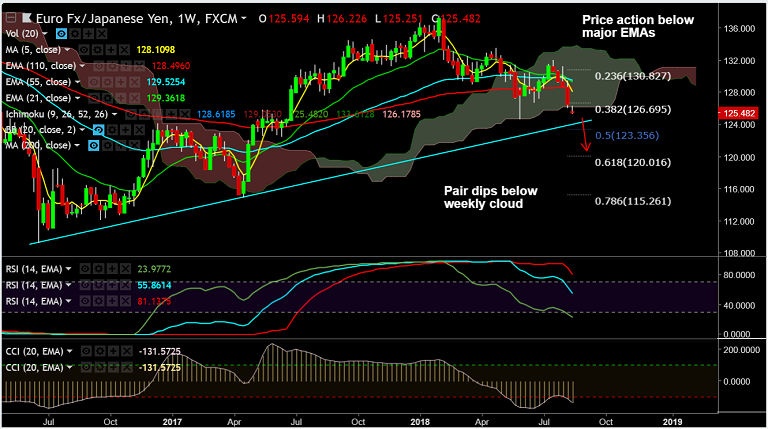

Refer EUR/JPY chart on Trading View

- EUR/JPY opens with bearish gap, hits 3-month lows at 125.25 as euro dented on Turkey's political crisis.

- The nation’s president Erdogan showed no signs of backing down in a standoff with the U.S.

- Continued turmoil in Turkey has sparked wider concern of market contagion, also raising worries about the exposure of European banks to crisis-hit Turkey.

- Adding fuel to the fire, US President Trump announced he authorized doubling tariffs on steel and aluminum to Turkey.

- The pair has slipped below weekly cloud and is on track to test strong trendline support at 124 levels.

- Technical studies have turned bearish and we see bearish invalidation only above daily cloud.

Support levels - 124.62 (May 29 low), 124 (trendline support), 123.35 (50% Fib)

Resistance levels - 126.19 (78.6% Fib), 127, 127.43 (61.8% Fib)

Recommendation: Good to go short on upticks around 125.40/50, SL: 126.20, TP: 125/ 124.65/ 124

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -75.4004 (Bearish), while Hourly JPY Spot Index was at 60.3365 (Bullish) at 0445 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.