After yesterday's Trump presidential impact, the majority of the FX pairs began rallying from previous day's losses, especially Asian currency crosses and stocks.

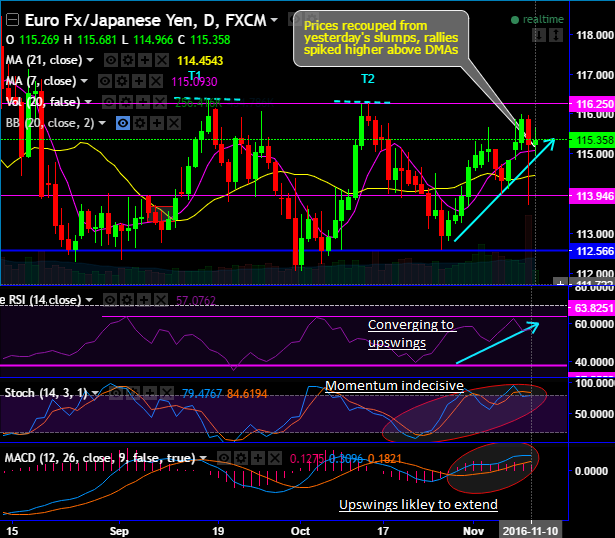

On the daily chart, you could see a bounce back from yesterday’s lows of 113.718 to the current 115.348 levels to signify the strength at this juncture. After testing support at 112.600 levels it has consistently been spiking higher from the last 3-4 weeks.

Earlier, we had traced out the double top pattern as well with 1st top at 116.365 levels and 2nd top at 116.280 levels on daily charts, we see the rallies to have ease of upside potential upto next stiff resistance at 116.250 levels as the current prices have consistently taking supports at 7DMAs and the major supports at double top neckline.

Currently, on daily plotting RSI (14) converging to the rallies at 57 levels and below 37 levels on monthly terms (while articulating).

While %D crossover at overbought zones doesn’t seem to be convincing the selling pressures and momentum is still indecisive on monthly charts.

While daily MACD signals upswings are likely to extend further in short run.

As stated earlier in our long-term trend analysis, although the current price behavior from last 4 and half months going non-directional, the consolidation phase or reversal to the major downtrend is dubious as we seek more clarity from the substantiating signals from other indicators.

The mMost probable scenario would be that it may retest recent highs of 116.250 levels in the days to come.

Trade tips: As a result of above technical reasoning, on speculative grounds we see opportunities in one touch binary call options that are the right trading choice for the day.

Those who are betting on today’s bullish sentiments, this strategy seem best suitable for certain yields but with leveraging effects. This is just for an intraday trading perspective, but in long run, this is certainly not yet an ideal time for fresh longs. Instead, wait for the better clarity.