OTC outlook:

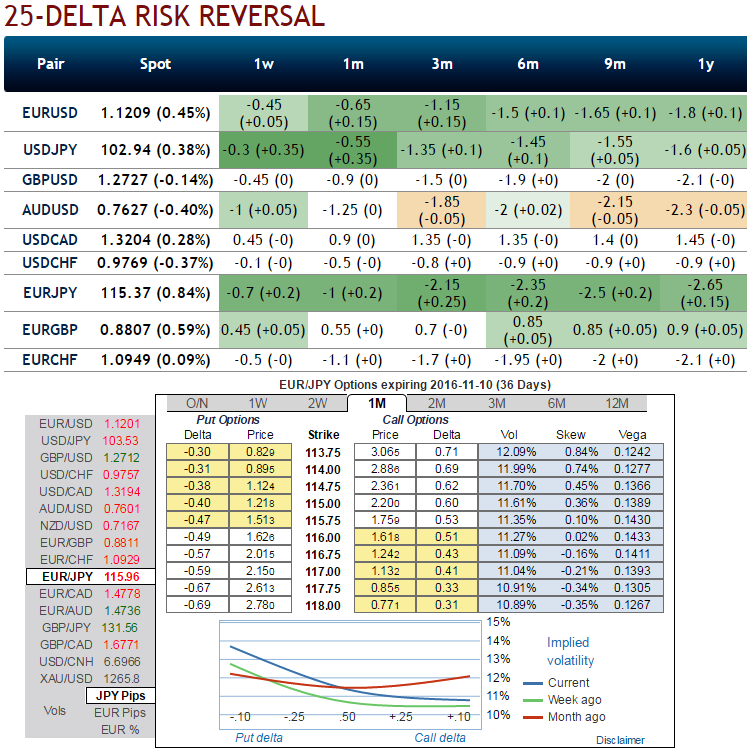

As the delta risk reversals have again shown in bearish interests but as the positive change in negative numbers signify the traction for hedging sentiments for further downside risks but with a rebalancing hedging bets.

While the current ATM IVs are spiking above 11.5% and these vols are positively skewed on OTM put strikes.

Option-trade recommendations:

Short Box Spreads:

Contemplating above OTC indications we reckon short box spreads are right choice on arbitrage grounds.

To execute this option strategy, we recommend following FX option positions:

Short an ITM call and go long in OTM call, simultaneously short ITM put and add longs in OTM puts of the similar expiries. The short box is a strategy that is used when the spreads are overpriced with respect to their combined expiration value.

Essentially, the arbitrager is just buying and selling equivalent spreads and as long as the net premium obtained for the selling the two spreads is significantly higher than the combined expiration value of the spreads, a risk-free profit could be attained upon entering these positions.

Bull/Credit t Put Spread (BPS):

As the risk appetite varies from different investors to different traders, we’ve customized our formulation of strategies for such varied circumstances.

On a hedging perspective, the foreign trader who are aggressively, expect slumps in the medium and long run but slight rise or sideway trend in short run, we advise use upswings to deploy “credit put spreads”

Trade tips:

Well, any abrupt upswings should not be panicky, instead deploy them in the below option strategy.

Using these deceptive rallies, you decide to initiate a bull put spread at net credits that is likely to fetch certain yields, short 1W (-1%) in the money put with positive theta if you expect that EURJPY will spike up moderately over the next near future but certainly not beyond your imagination, simultaneously, buy next month at the money -0.49 delta put option.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields