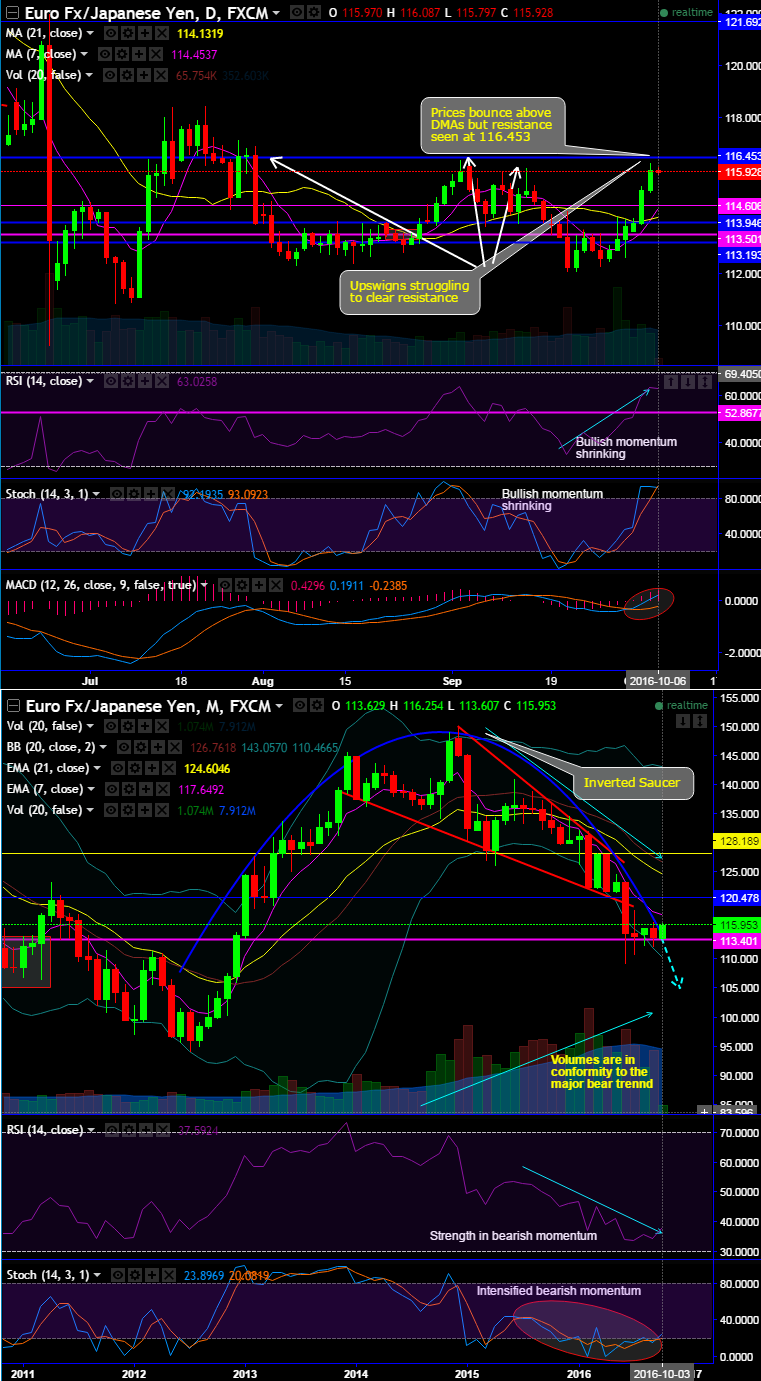

On daily terms, although bulls seem to be attempting to extend rallies but seem to have exhausted at stiff resistance 116.453 levels considering the previous declining swings at the same juncture, bullish momentum is shrinking as leading oscillator (stochastic) halts in overbought zone.

Despite the pair is bullish bias in short term, it seems to be struggling to clear 116.453 levels and the hold momentum in recent gains.

RSI has been positively converging to the upswings.

The current prices have jumped above well DMAs with 7DMA crossing over 21DMA and MACD has also evidenced bullish crossover (see daily chart).

On the contrary, the pair is still steaming up with heaps of other bearish indications by both leading and lagging indicators on monthly charts.

Currently, RSI monthly plotting has been converging below 38 levels with long term bear declining trend.

While stochastic curves have reached oversold region but unable to generate convincing buying interest despite rising prices (no traces of %k crossover).

Most notably, the price behaviour is on the verge of extension of inverted saucer pattern.

As stated earlier in our long-term trend analysis more downside targets are on the cards as the bears taking over the rallies to evidence every dips with ease and with huge volumes (see monthly charts for volumes conformity).

The most probable scenario would be that it may retest recent lows of 116.453 levels but sustenance above is struggling.

FX Option Strategy:

Well, on intraday terms, the trade strategy would be the boundary binary options by using cash-or-nothing options with upper strikes – 116.453; lower strikes around 115.420 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot FX.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 116.453 > Fwd price > 115.420).