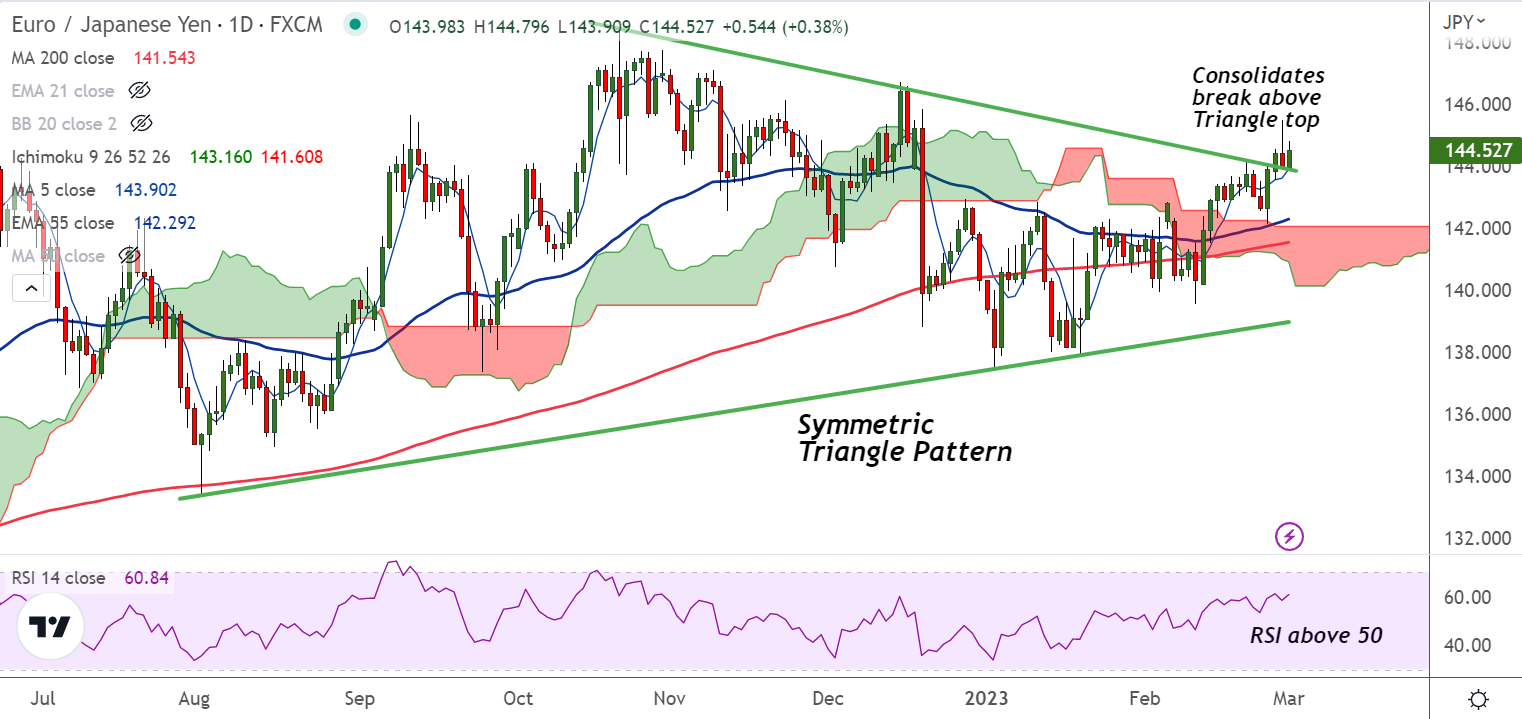

Chart - Courtesy Trading View

Spot Analysis:

EUR/JPY was trading 0.38% higher on the day at 144.53 at around 09:40 GMT.

Previous Week's High/ Low: 144.16/ 142.14

Previous Session's High/ Low: 145.47/ 143.87

Fundamental Overview:

The Japanese Yen’s weakness due to dovish Bank of Japan (BoJ) commentaries pushes the pair higher.

BoJ policymakers are considering the current expansionary monetary policy as appropriate to maintain the 2% inflation confidently.

Germany’s Unemployment Rate stood unchanged at 5.5% in January, the latest data published by Destatis showed on Wednesday. The market consensus was for a 5.5% reading.

The Unemployment Change arrived at 2K in January, rebounding from December’s drop of 15K while way below the market expectations of 19K.

Technical Analysis:

- EUR/JPY has shown a breakout above 'Symmetric Triangle' raising scope for more gains

- Momentum is bullish, volatility is high and rising, Chikou span is biased higher

- GMMA indicator shows major and minor trend are bullish

- MACD and ADX support further gains in the pair

Major Support and Resistance Levels:

Support - 143.90 (5-DMA), 143.62 (200H MA)

Resistance - 145.25 (Upper BB), 145.47 (Feb 2023 high)

Summary: EUR/JPY poised for further gains. Failure to hold above above 'Triangle Top' negates further gains.