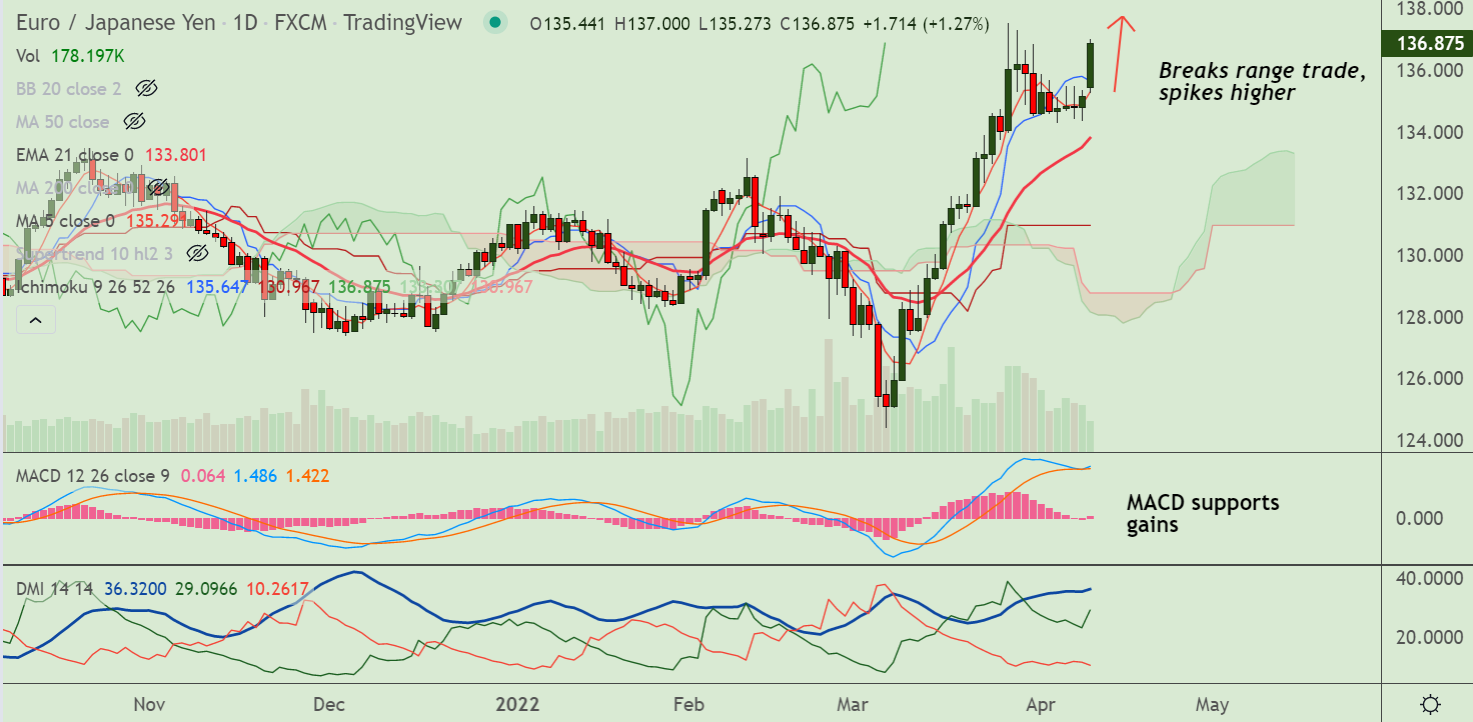

Chart - Courtesy Trading View

EUR/JPY was trading 1.26% higher on the day at 136.84 at around 10:45 GMT, erasing some gains from monthly highs at 136.99.

The Japanese yen weakened across the board after the Bank of Japan cut its assessment for most regional economies.

Further weighing on the yen was BoJ Governor Haruhiko Kuroda's warning of very high uncertainty over the fallout from the Ukraine crisis.

EUR/JPY is showing a good bullish breakout after extending sideways grind for past few session's.

MACD and ADX support upside in the pair. Chikou span is biased higher. GMMA indicator shows major and minor trend are strongly bullish.

Support levels - 135.29 (5-DMA), 134.60 (5-week MA), 133.98 (20-DMA)

Resistance levels - 137, 137.83 (Upper BB), 138

Summary: EUR/JPY trades with a bullish bias. After a brief pause in the previous week's trade, the pair has resumed upside and is set to test new multi-year highs.