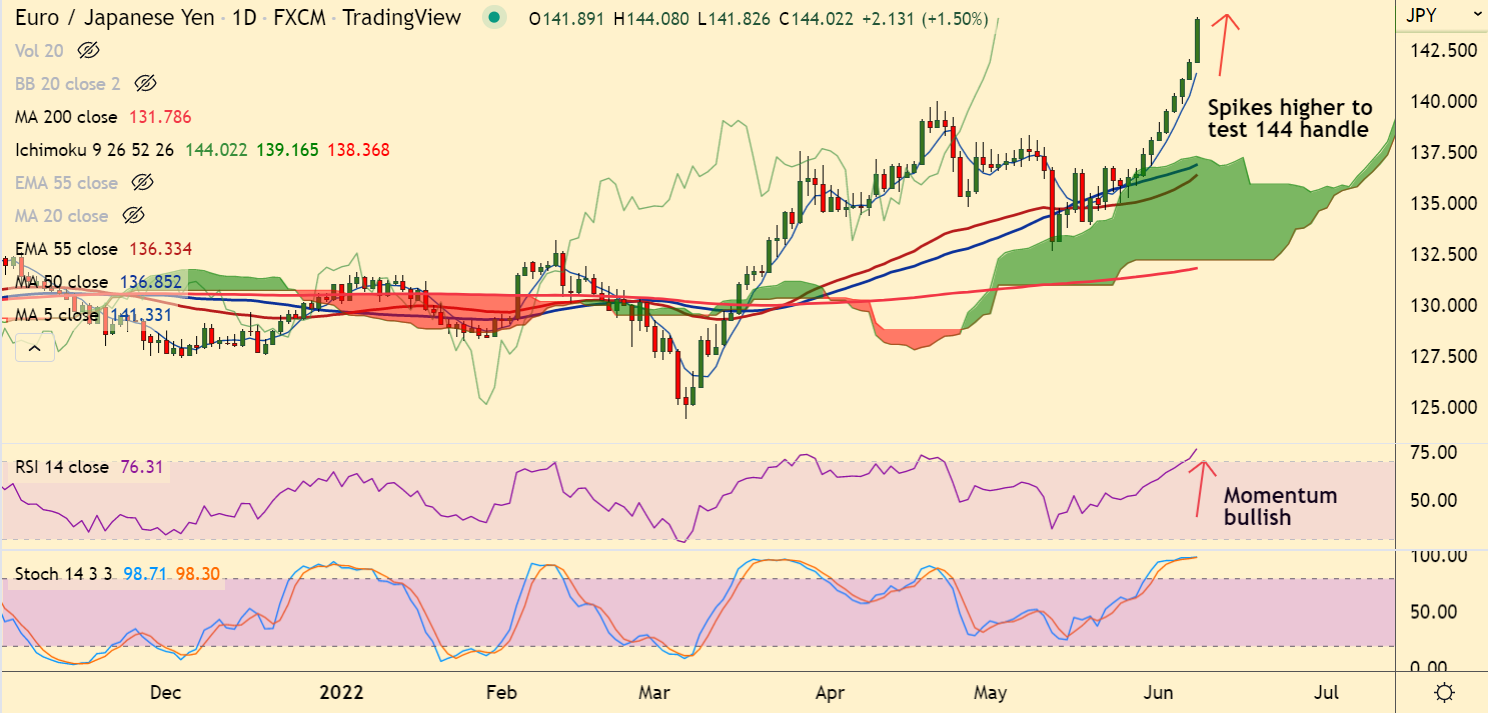

Chart - Courtesy Trading View

EUR/JPY was trading 1.51% higher on the day at 144.03 at around 12:25 GMT. Outlook bullish.

The Eurozone economy expanded by 0.6% in Q1 of 2022 vs. 0.3% prior, the final revision confirmed on Wednesday, beating market consensus for a reading of 0.3%.

On an annualized basis, the bloc’s GDP rate rose by 5.4% in Q1 vs. 5.1% booked in Q4 2021 while matching 5.1% expectations.

Further, the bloc’s Q1 Employment Change arrived at 0.6% QoQ and 2.9% YoY, also above expectations.

The single currency finds strong support, stays bid ahead of the European Central Bank (ECB) meeting on Thursday.

Rising changes for the central bank to sound more hawkish, which could trigger a re-price higher of rate hikes expectations, likely to keep the euro buoyed.

Technical bias for the pair is bullish. Momentum with the bulls, volatility is high, scope for further upside. Next bull target 145.32 (Jan 2015 high).