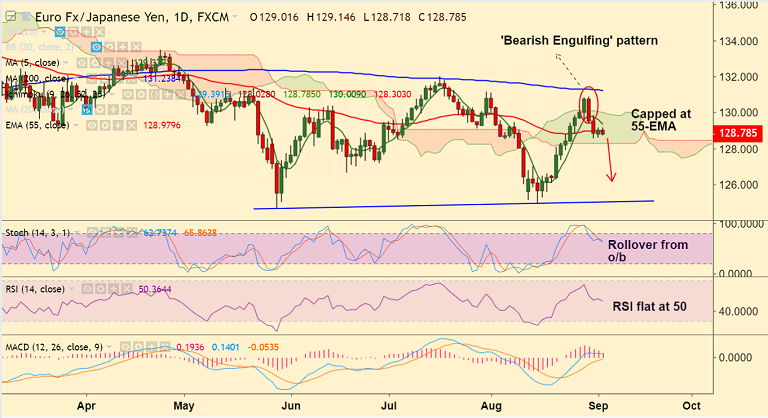

EUR/JPY chart on Trading View used for analysis

- EUR/JPY downside remains intact, pair is struggling to hold gains above 55-EMA.

- The single currency dampened after Fitch downgraded Italy's debt outlook to negative on Friday.

- Widening Italy-German (DE) 10-year yield spread pose further threat, dragging EUR lower.

- Technical indicators are turning bearish. Minor recovery attempts lack traction.

- We evidence a 'Bearish Engulfing' pattern on the daily charts and a 'Shooting Star' on the weekly charts which keeps downside bias in the pair intact.

- Downside is holding support at 21-EMA, break below eyes 20-DMA at 128.01. Further weakness likely on break below.

- On the flip side, breakout at 5-DMA could see further upside. Bearish invalidation only above 200-DMA.

Support levels - 128.72 (21-EMA), 128.01 (20-DMA), 127.15 (June 28 low)

Resistance levels - 128.97 (55-EMA), 129.37 (5-DMA), 131.23 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-JPY-recovery-capped-at-55-EMA-widening-Italy-German-yield-spread-to-prompt-further-declines-1423076) is progressing well.

Recommendation: Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -40.4219 (Neutral), while Hourly JPY Spot Index was at 128.522 (Bullish) at 1015 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.