The eurozone economic growth has slowed and there are risks of a recession.

The ECB, for the near future, ceased QE-related bond purchases in December, but there are risks any tightening will be delayed if growth slows materially. We revise our forecast for Q2 from 1.65 to 1.7050 levels.

RBNZ, on the flip side, is scheduled for its first monetary policy, which is most likely to maintain status quo in its OCR rates as the governor Orr had stated in the previous meetings that the OCR would need to be on hold until 2020 in order to sustainably hit the inflation target. Although Kiwis dollar slightly gains upside traction, major downtrend remains intact. We listed out some driving forces of EURNZD’s bullish risks:

1) The NZ housing market slowdown becomes disorderly;

2) Kiwis immigration rolls over more quickly;

3) Weak business confidence sees firms dramatically cut hiring.

4) US Fed concludes the hiking cycle but with European growth back above 2% (more 2006 than 2000;

5) The continued robust CB demand for EUR.

OTC outlook and Hedging Strategy:

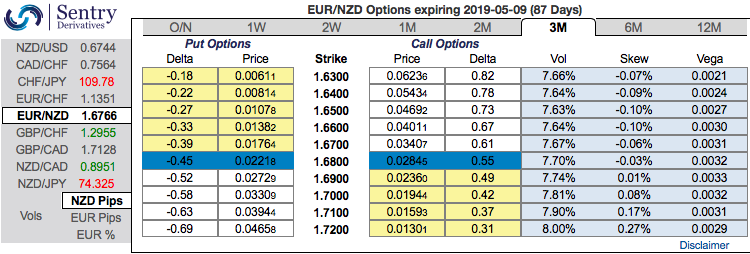

Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests in the upside risks (refer above nutshell). Bids for OTM calls strikes up to 1.72 levels are observed ahead of RBNZ monetary policy.

Contemplating all the above factors, we could foresee the upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 15 levels (which is mildly bullish), NZD at -84 (highly bearish) while articulating (at 14:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025