• EUR/NZD edged higher on Tuesday but gains were limited as investors digested German factory orders, German Trade Balance, Eurozone Retail Sales data and RBA policy outcome.

•The RBA left its OCR unchanged at 4.35%, as anticipated. Data released by Eurostat on Tuesday revealed retail sales in the euro area advanced by 0.8% month-on-month in March.

•German exports rebounded in March, but industrial orders took an unexpected dip. After a 1.6% decline in February, exports surged by 0.9% month-on-month.

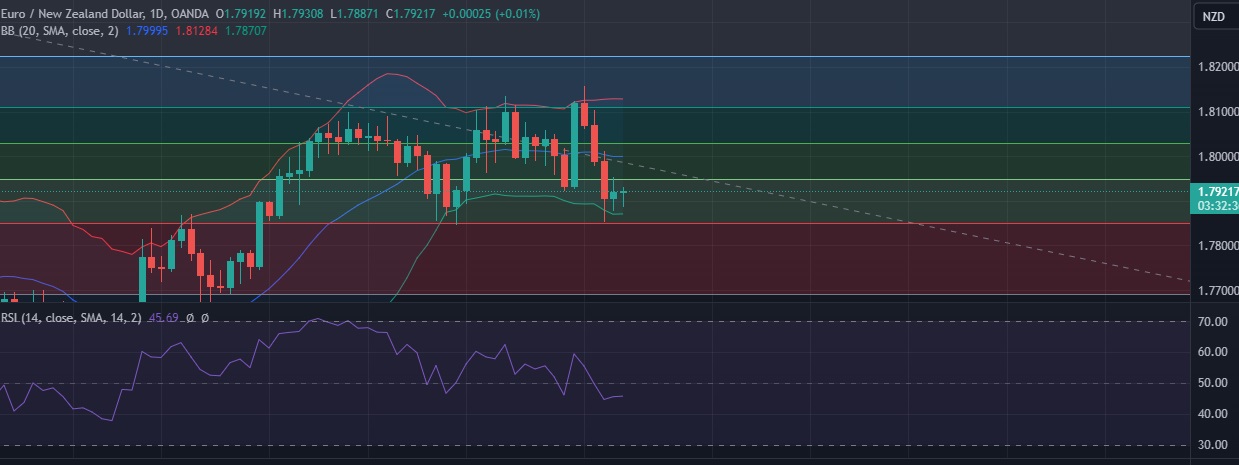

•EUR/NZD has seen a 1.7879 -1.7953 range on Tuesday . Today’s bounce away from support likely to remain shallow.

• Technical signals show the pair could gain more ground in the short-term as RSI is at 46 bearish daily momentum studies 5, 9 and 11 DMAs are trending down.

• Immediate resistance is located at 1.7946(38.2%fib), any close above will push the pair towards 1.8027(50%fib).

• Strong support is seen at 1.7870(Lower BB) and break below could take the pair towards 1.7850 (23.6% fib )

Recommendation: Good to sell around 1.7940 with stop loss of 1.8100 and target price of 1.7850