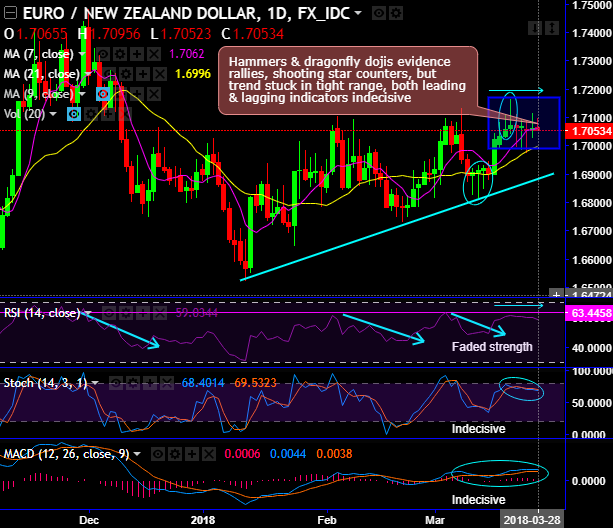

Chart pattern formed- Hammers have occurred at 1.6905, 1.6913 & 1.6921 levels and dragonfly dojis at 1.7058 levels (refer daily chart).

These bullish patterns evidence rallies, whereas shooting star counters the rallies, consequently the trend is stuck in the tight range.

While both leading & lagging indicators are indecisive on daily plotting.

On a broader perspective, hanging man has occurred at peaks of 1.7336 levels that plummets prices, on the contrary, hammer counters slumps at 1.6817 levels, thereby, you see a tight tug of war between bullish & bearish swings in the current trend that is stuck in the tight range between 1.7163 and 1.6522 levels (on weekly plotting).

21-DMA and 21-EMA on both daily and weekly terms respectively act as the strong support levels.

While the short-term trend has recently been testing the range support at 1.6971 levels, consequently, made a fake high upto 1.7113 levels to restrain between the ranges.

While RSI, so far, has been converging upwards along with the price rallies that signals faded strength for now. Stochastic curves have also been indecisive.

Stiff resistance is observed at 1.7106, 1.7285 and 1.7552 levels.

The current price spikes above EMAs with bullish momentum, the sustenance above will extend rallies.

Both lagging indicators (EMAs and MACD) do not substantiate the bullish environment.

Trade tips:

Contemplating prevailing trend coupled by the trend indicators, it is wise to bid for longs in the straddles that contains at the money calls and at the money put of 1m tenors to mitigate potential FX risks on either side. One can utilize this options strategy on trading grounds as well to fetch rise in payoff structure of premiums regardless of swings.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 63 levels (bullish), while hourly NZD spot index was at 97 (bullish) while articulating at 06:50 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: