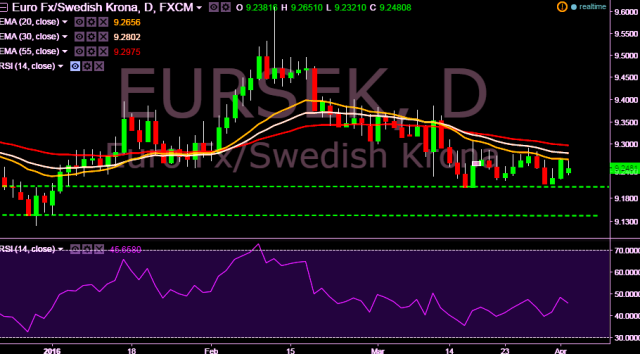

- EUR/SEK is currently trading around 9.2570 levels.

- It made intraday high at 9.2651 and low at 9.2321 levels.

- Pair fails to break key resistance at 9.2676 and supported below 9.2600 marks.

- Intraday bias remains bearish for the moment.

- On the top side key resistances are seen at 9.2718, 9.2774, 9.2871 and 9.3082 marks.

- A daily close below 9.2129 will drag the parity down towards key supports at 9.2050/9.1471 marks.

- Important to note here that 20D, 30D and 55D EMA heads down and signals bearish trend.

We prefer to take short position in EUR/SEK around 9.2580, stop loss 9.2676 and target 9.2050 marks.