EURUSD’s upswings are observed from last 2-3 days in a row ever since it has jumped from the lows of 1.1183 levels. However, the interim upswings unlikely to sustain in the long-run. We emphasized this bearish stance even in our technical section.

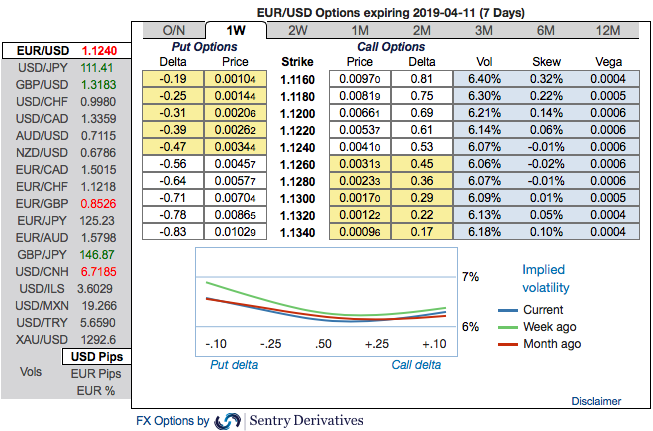

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiment remain intact.

Please be noted that EURUSD shows a divergence between implied volatility (IV) and historic volatility (HV) curves. Also, be noted that the spot curve getting converged to the risk reversal curve. Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above chart, Jan’2018 seems to be an average month as the divergence between implied volatility and historic volatility. IVs have constantly been sliding, while RVs are resisting.

While 1w skews are stretched on either side (equal interest in both OTM call and OTM puts), 3m positively skewed IVs have still been signaling downside risks. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

To substantiate these indications, bearish neutral RRs across all tenors, which is in line with the above-stated bearish scenarios. But one could observe a positive shift in 1m tenors which is again as per the 1w skews.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with hedging grounds can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -9 levels (which is neutral), while hourly USD spot index was at -4 (neutral) while articulating (at 07:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges