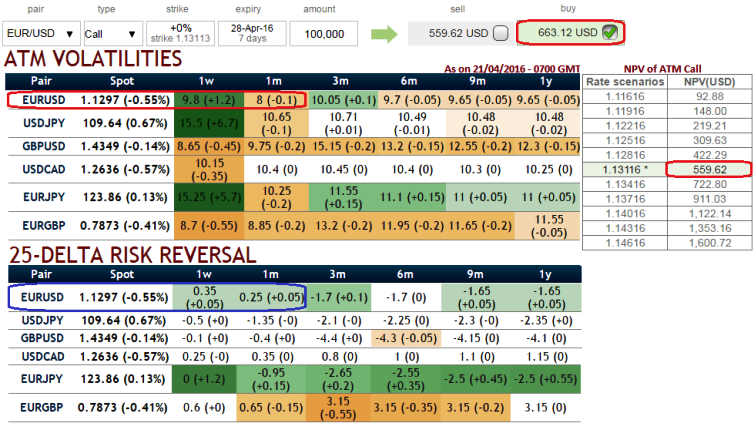

At spot FX flashes of EURUSD at 1.1302 we see delta risk reversal for contracts of 1W and 1M expiries have shown bullish recovery signals, but in long term (3M-1Y) put contracts are on higher demand.

But the participants seems to have shrugged off the bullish hedging sentiments in EURUSD OTC FX markets as you can make out from the nutshell showing EURUSD’s implied volatilities of 1M at the money contracts are shrinking away, the least among G7 currency space, almost at 8%.

As a reminder, this feeble IV represents no much movement in underlying FX market could be expected from EURUSD during the life span of the option.

In that respect, an option buyer is partially buying the market's expectations for this pair.

Contemplating these factors and synthesizing while projecting the trend, how do you want to stay long but worried about sluggish IVs in OTC FX markets that are not substantiating overpriced premiums:

1W ATM IVs of this pair are at 9.8% and the premium on 1W call are trading 18.4% more than Net Present Value, hence it is deemed as a huge disparity between option prices and volatilities in FX option markets.

A synthetic long call is created when underlying spot FX position is combined with a long put of the same series.

It is so termed because the established position has the same profit potential as a long call. Profitability through this strategy would be unlimited as same as naked calls, maximum risk would be to the extent of initial premium paid to play the role of put holder.