The euro has started the trading week with minor gains, as the Fed left its funds rate unchanged the pair surges to 1.1086 levels, fed officials also mentioned global risks less are not significantly posing any threats to the US.

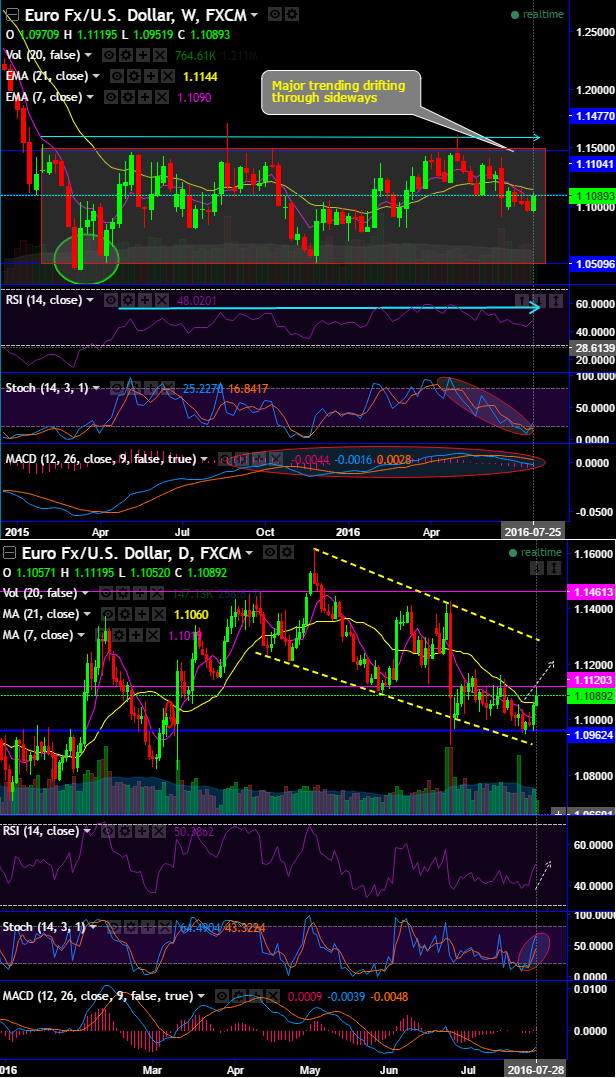

Although EURUSD has gained 0.33% to a two-week high of 1.1095, we think the pair would drift in the sideway trend that has been persisting months to gather (see weekly charts).

Data earlier showed that the number of unemployed people in Germany declined by 7,000 in July, compared to expectations for a 3,000 drop and after a 6,000 slide the previous month.

The pair has taken support at 1.1052 levels (i.e. 21DMA) and jumped above 30 pips while leading oscillators are converging to the rallies.

RSI (14) on weekly has been indecisive to signal the sideway trend. This technical indication has started evaluating the momentum when prices touched 1.1060 by taking the computation of last 14 day periods the magnitude of recent gains to recent losses in an attempt to signify the overbought pressures.

While Stochastic curves on weekly have approached oversold territory but no traces of clear crossover %K crossover.

MACD, on the other hand, has been hovering around zero levels with bearish crossover and it signals the sideway trend to drag down further in the weeks to come.

Hence, in the long run, we still project below cyclical lows of 1.08 in Q4 2016.

Since the daily trend has been sliding southwards in a channel but for the day trend is bias upwards. Considering a stiff resistance at 1.1120 levels, boundary binaries are advisable to speculate this pair with upper strikes at 1.1120 and lower strikes at 1.1060 levels for leveraging effects of 50-60 pips.