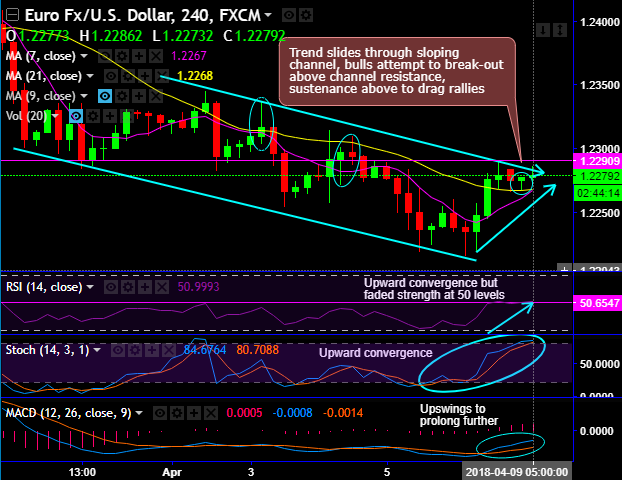

EURUSD minor trend has been sliding through sloping channel and shown failure swings at the stiff resistance of 1.2290 levels.

The resumption of bears with the failure swings at this stiff resistance likely to evidence steep price slumps on hanging man formation, consequently, we are seeing the prices sliding towards DMAs again.

On the contrary, any break-out above this channel resistance and sustenance above likely to drag rallies (refer 4H plotting).

The price behavior has been jerky today as it goes in sideways, however, bears have been attempting to drag the slumps from today’s highs at 1.2286 levels.

RSI has shown a faded strength at 50 levels. While bullish momentum remains intact.

Both trend indicators MACD and SMAs signal upswings to prolong further.

On the flip side, in the broader perspectives, consolidation phase in the major trend that was bullish now turned into bearish. After last two-three months struggle for healthy bullish momentum, the current prices have popped up a flurry of bearish patterns, such as hanging man, shooting star at peak of rallies (see the circled area on weekly terms) coupled with bearish MACD crossover on monthly terms.

While both leading oscillators (RSI & stochastic curves) show downward convergence that indicates strength and bearish momentum.

Hence, at spot reference: 1.2277 levels, contemplating bearish sentiments in the minor trend, on trading grounds, it is advisable to buy tunnel spread. The binary options strategy using upper strikes at 1.2290 and lower strikes at 1.2241 levels are advocated to participate in the bearish sentiments.

Thereby, the intraday traders can speculate between upward targets about 20-25 pips on the north and about 30 pips southwards. The strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but to remain above lower strikes on the binary expiration.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 46 levels (which is bullish). While hourly USD spot index was inching towards -93 (bullish) while articulating (at 06:35 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: