FxWirePro: EUR/USD resumes downside after failing to break resistance level at 1.1190

Tuesday, February 16, 2016 3:22 PM UTC

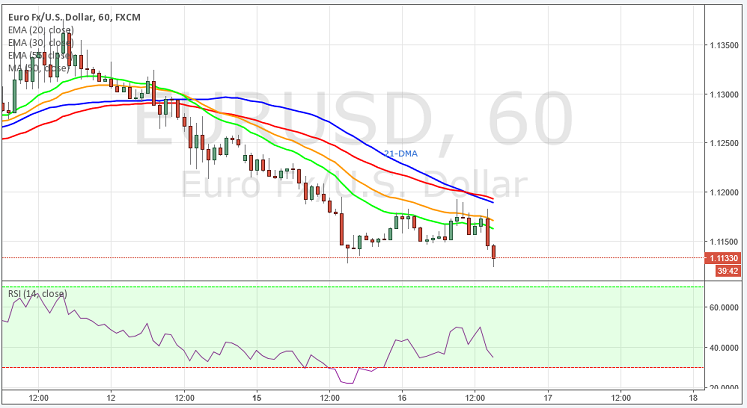

- The EUR/USD pair is trading as low as 1.1132 in the early the US session as the pair attracted sellers after soft German ZEW Economic Sentiment data. The pair initially bounced back towards 1.1190 level. However after finding minor resistance at 1.1190 upside was short lived, and the pair declined towards lower levels.

- The ongoing weakness is set to continue for this pair as the resistance level at 1.1249 is likely to act as strong barrier to the bulls and bring a further decline towards lower levels, therefore it's good to sell this pair around 1.1190 levels.

- Technically the pair has extended its decline below its 21 DMA, the RSI in the 4 hour chart is indicating downwards at 35, meanwhile the 55, 30 and 20 MA's are pointing strong bearish momentum towards lower side. Overall the technical indicators are depicting further downtrend for this pair.

- To the upside, the strong resistance can be seen at 1.1249, a break above will take the pair towards next resistance level at 1.1300.

- To the downside immediate support can be seen at 1.1130 levels, a break below will open gates towards 1.1084 levels.

Recommendation: Go short around 1.1190, targets 1.1100, 1.1050, SL 1.1250

Resistance Levels

R1: 1.1191 (Daily high)

R2: 1.1249 (50% Retracement level)

R3: 1.1300 (Psychological levels)

Support Levels

S1: 1.1130 (38.2% Retracement level)

S2: 1.1084 (Feb 8th lows)

S3: 1.1003 (23.6% Retracement level)