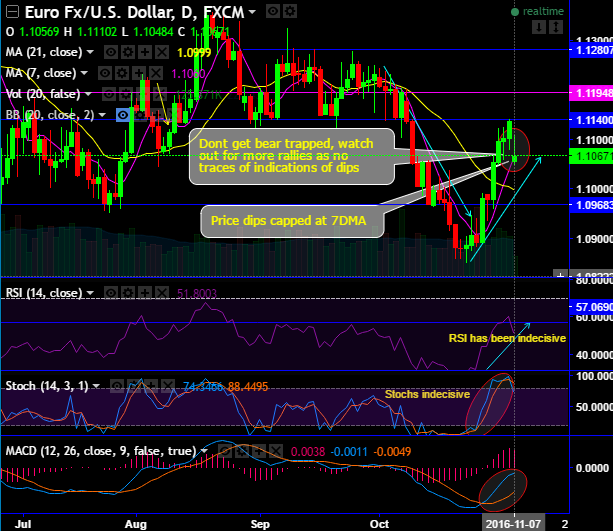

The dollar has begun the trading week with gains after the rejection of today’s highs of 1.1141 levels, and the resistance stiff resistance is at these levels (it has tested supports several times in the recent past, now rallies making this level as strong supply zone).

As a result, a resembling shooting star is popping which seems to be deceptive as you don’t see any substantiation signal from leading and lagging indicators. So, this pattern should not be deemed as bearish signal and get trapped in bear swings.

But for today, despite today’s price dips, the bulls also hold stronger at 1.4050 levels (i.e. near 7DMA), thereby, we observe any bounce back and break out above 1.1140 would drag the rallies to 1.1194 and 1.1280 levels, we also see major support at 1.0999 and 1.0968 levels.

On a broader perspective, the major non-directional trend likely to prolong again as bulls resume after last months’ losses (see monthly charts).

Any abrupt panicky dips should see the strong immediate supports at 1.0962 levels (see monthly plotting).

On intraday speculation purpose, contemplating above technical reasoning, we could foresee equal chances for both bears and bulls with 7DMA as strong support with slight bullish bias.

Hence, double touch option is useful for traders who believe the price of an underlying asset would undergo a large price movement, but who are unsure of the direction.

A trader can use a double touch option with barriers at 1.1110 and 1.1030 to capitalize on this outlook.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.

In this case, the trader stands to make a profit if the rate moves beyond either of these levels before expiry, and he/she stands to lose the premium if the rate remains within these barriers.

This will end up putting the trader in a position to gain profit from a boost in the asset price or even a decrease.

Usually, it’s wise to manage both sides of a motion when the asset price is shifting around in a changeable manner.

Alternatively, we think the pair from here onwards largely bullish in short run atleast, and advisable to capture the dips to deploy longs in near month futures are a wise trading idea, then the next targets would be seen at 1.1194 and 1.1280 levels in the days to come.