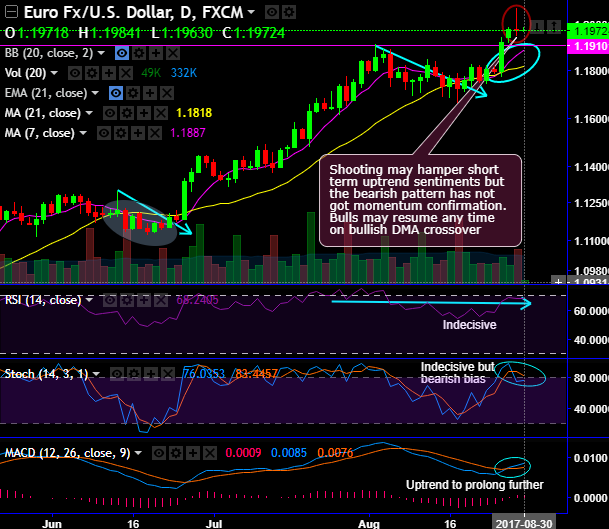

In yesterday’s rallies, shooting star candlestick pattern has occurred at the peaks of 1.1971 levels. Consequently, today’s trade sentiment has been little edgy during Asian trading sessions.

Shooting may hamper short term uptrend sentiments but the bearish pattern has not got momentum confirmation from the leading oscillators. Both RSI and stochastic curves have been indecisive.

While both lagging indicators have been in bulls’ favor, 7DMA has crossed over 21DMA which is the bullish crossover (daily chart). MACD, on this timeframe, has evidenced bullish crossover that still indicates upswings most likely to prolong further.

Hence, bulls may resume any time upon these indications.

On a broader perspective, bulls have managed to break-out long lasting range bounded trend (refer rectangular area on monthly plotting), massive volumes in conformity to the upswings. More rallies on cards upon bullish EMA crossover.

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction ahead of today’s German and Spanish CPI numbers, flashing positive numbers, shy above 50 levels (bullish), while hourly USD spot index was inching towards -10 (neutral) at the time of articulating (at 05:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

http://www.fxwirepro.com/invest

Trading tips:

On intraday speculative grounds, contemplating momentary bearish indication we see the price to remain within the range between 1.2070 and 1.1886 (i.e. 7DMA levels). Hence, we advocate buying boundary binaries with upper strikes at 1.2070 and lower strikes at 1.1886 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential than spot trades.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.2070 > Fwd price > 1.1886).