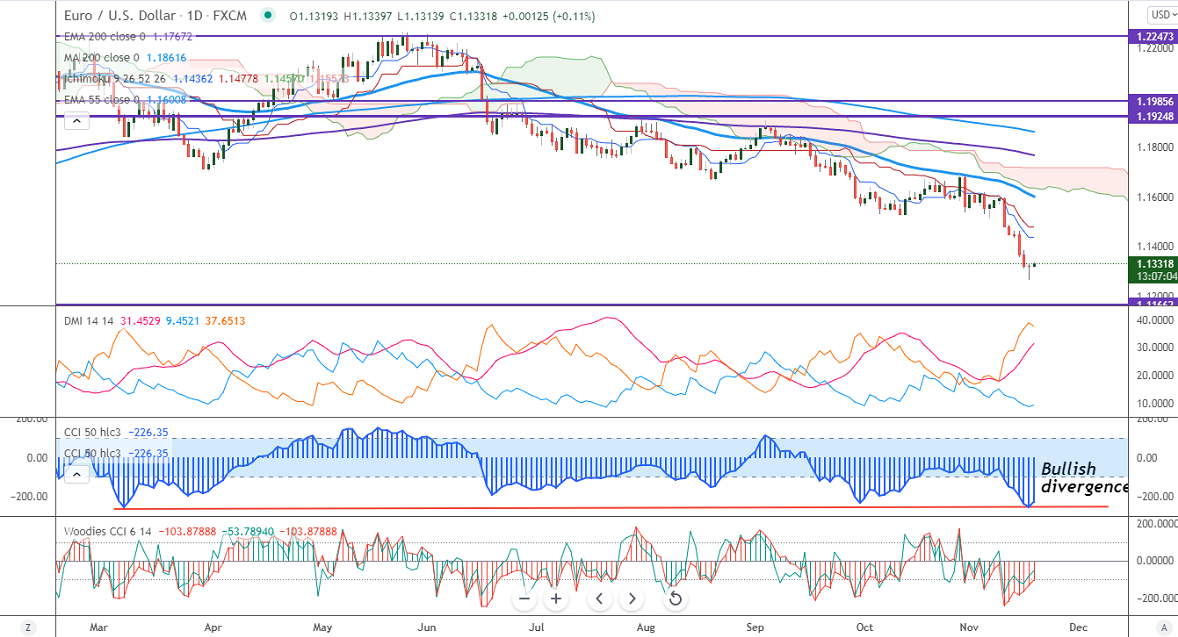

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.14362

Kijun-Sen- 1.14778

Bullish divergnece CCI (50) in daily chart

EURUSD bounced from a 16-month low of 1.12634 on short covering. The pair was one of the worst performers in the past two weeks and lost more than 30 pips on board-based US dollar buying. The US dollar surged after upbeat US CPI and upbeat economic data increased hopes of a rate hike before mi 2022. Markets eye US Philly Fed manufacturing index and initial jobless claims for further direction. EURUSD hits an intraday high of 1.13385 and is currently trading around 1.13328.

Technical:

On the higher side, near-term resistance is around 1.13340 and any convincing breach above will drag the pair to the next level 1.13625/1.1400/1.14590/1.14845. The pair's immediate support is at 1.1300 breaking below targets of 1.1250/1.1200/1.1160.

Indicator (Daily chart)

Directional movement index – Bearish

It is good to buy on dips around 1.1300-025 with SL around 1.1250 for a TP of 1.1460.