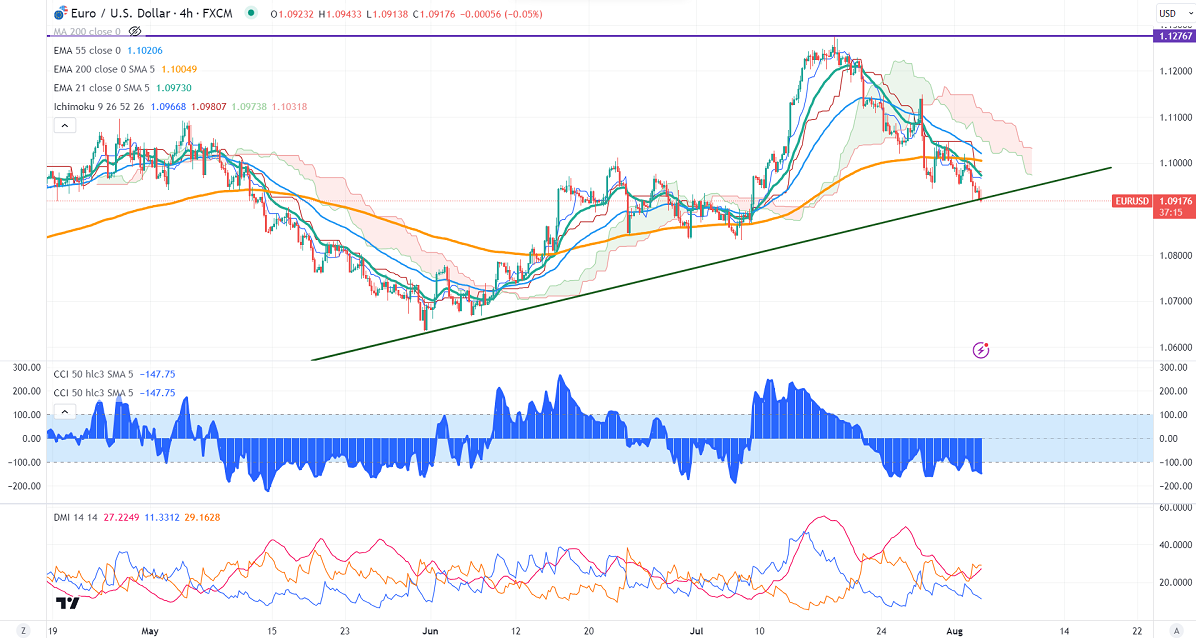

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.09688

Kijun-Sen- 1.09827

EURUSD pared most of its gains on board-based US dollar buying. The pair gained above 1.1000 after Fitch downgraded the US credit rating from AAA+ to AA+. The increase in the chance of rate hikes by the Fed is due to strong economic data putting pressure on the Euro at higher levels. It hits a low of 1.09138 and is currently trading around 1.09219.

US private sector employment increased by 324000 in Jul, compared to a forecast of 185000.

Major economic data for the day

Aug 3rd, 2023, BOE monetary policy (11 am GMT)

Unemployment claims (12 am GMT)

US ISM services PMI (2 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 78.70% a week ago.

The US 10-year yield gained sharply after upbeat US private sector jobs. The US 10 and 2-year spread narrowed to -78.10 from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break below 1.0900 confirms further bearishness: a decline to 1.0850/1.0800 is possible. The near-term resistance is around 1.0950. The breach above targets 1.100/1.1050.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.0950 with SL around 1.1000 for a TP of 10800.