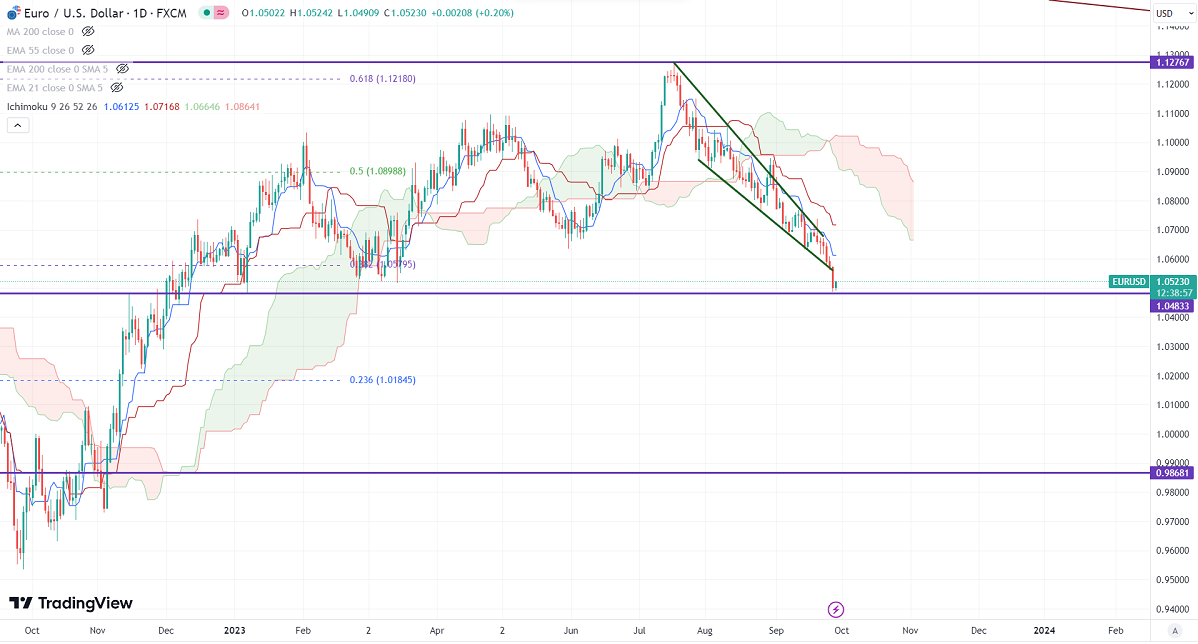

Double bottom - 1.04800

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.06125

Kijun-Sen- 1.07168

EURUSD declined sharply and hit a month low on the strong US dollar. It hit a low of 1.05559 and is currently trading around 1.05650.

US durable goods orders rose 0.20% in August vs. -0.50% expected. Core durable goods orders jumped 0.40% in August, compared to a forecast of 0.20%.

Markets eye US final GDP, US jobless claims, and Powell's speech for further direction.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov decreased to 76% from 73.70% a week ago.

The US 10-year yield climbs above 4.60% on strong US economic data. The US 10 and 2-year spread narrowed to -52.2% from -75%.

The pair trades below short-term 21 EMA, below 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break below 1.04800 confirms further bearishness. A decline to 1.04350/1.0400 is possible. The near-term resistance is around 1.0550, any breach above targets is 1.0600/1.0660/1.0700/1.0760.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to buy on dips around 1.05150 with SL around 1.047 for a TP of 1.0600