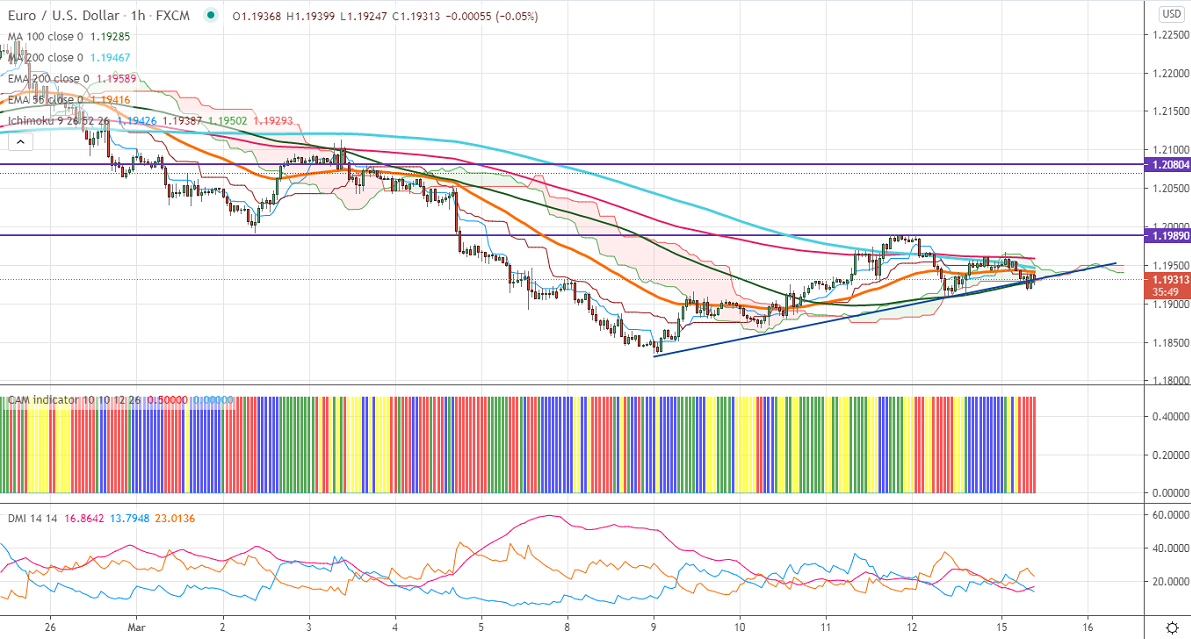

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 1.19426

Kijun-Sen- 1.19387

EURUSD has once again declined after a minor jump above 1.19500 on rising US bond yield. US 10-year yield jumped more than 10% in the past two days is supporting the US dollar at lower levels. DXY jumped more than 30 pips from a minor bottom around 91.54. EURUSD hits an intraday low of 1.19178 and is currently trading around 1.19303.

US producer price rose 0.5% in Feb slightly better than forecast 0.4%. The inflation in Jan surged sharply to 1.3%, the highest since 2009. The University of Michigan consumer sentiment raised to 83 from 76.80 in Feb.

Technical:

The pair is facing strong support at 1.1900. Any break below confirms minor bearishness, a dip till 1.1835/1.1800 likely. The near-term resistance is around 1.1200. An indicative breach above will take the pair to next level till 1.2035/1.20634 (200- 4H MA). Short-term trend reversal only above 1.2260.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1928-30 with SL around 1.1985 for the TP of 1.18300.