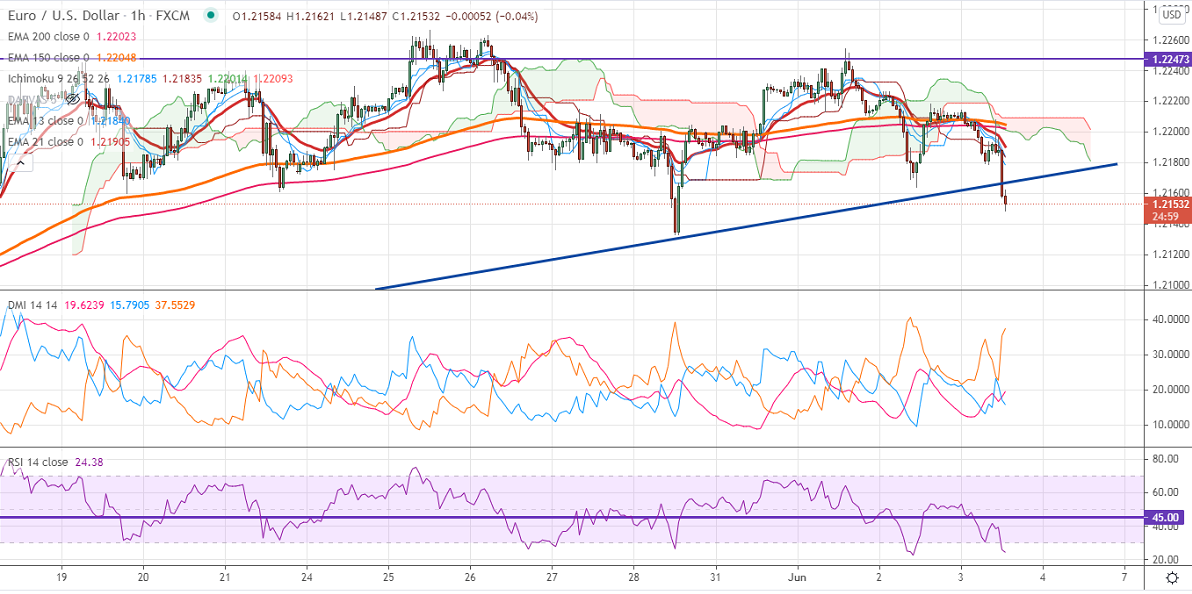

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21876

Kijun-Sen- 1.22022

EURUSD lost more than 50 pips on upbeat US ADP data. The US private sector has added 978000 jobs in May much better than the forecast of 650K. The number of people who have filed for unemployment benefits declined to 385K for the week ended May 28 vs an estimate of 395K. DXY is holding above 90 levels; any breach above 90.50 confirms a short-term uptrend. The comment from Fed Philadelphia President Harker on tapering bond-buying also supporting the US dollar. EURUSD hits an intraday low of 1.21471 and is currently trading around 1.21521.

Technical:

On the higher side, near-term resistance is around 1.2220, and any convincing breach above will take the pair to next level 1.2260/1.2300/1.23485. The pair's near-term support is around 1.2150, violation below that level targets 1.2120/1.2070/1.20380 (100- day MA)/1.1980.

Indicator (1-hour chart)

RSI- Bearish

Directional movement index –bearish

It is good to sell on rallies around 1.2178-80 with SL around 1.2220 for the TP of 1.2050.