FxWirePro- EURUSD Daily outlook

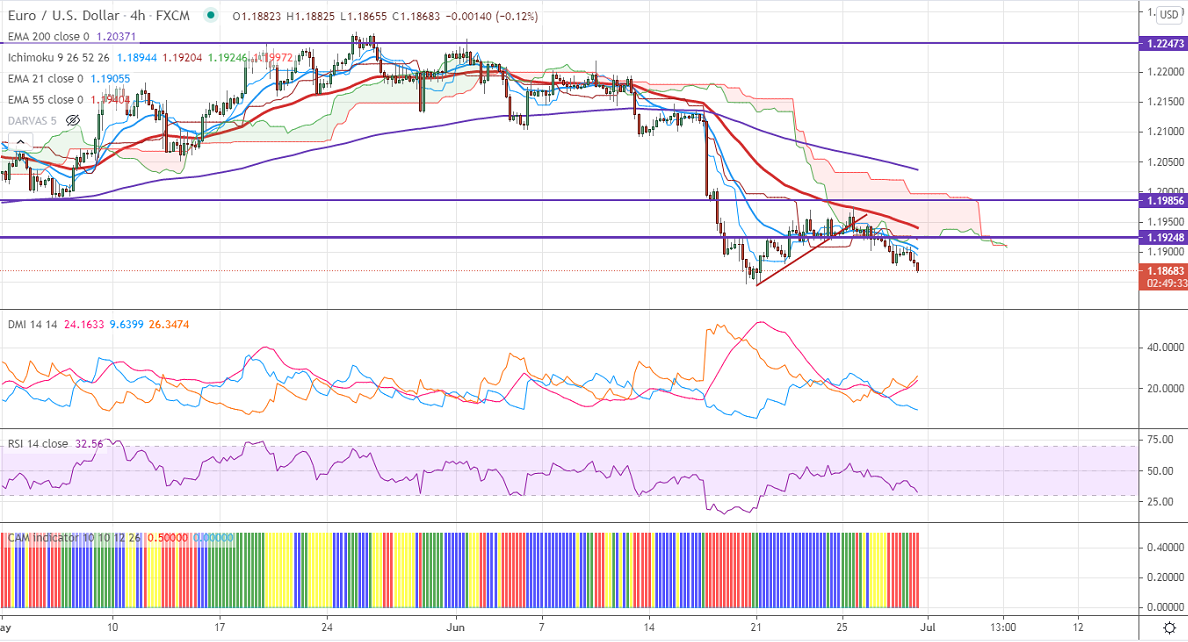

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.19000

Kijun-Sen- 1.19257

EURUSD is trading weak for 3rd consecutive days and lost more than 70 pips on board-based US dollar buying. US private companies have added 692000 jobs in June, much better than the forecast of 55000. The spread of delta variant in Europe and surge in Eurozone. DXY is holding above 92 levels, any breach above 92.50 confirms further bearishness. The pair hits an intraday low of 1.18682 and is currently trading around 1.18690.

Technical:

On the higher side, near-term resistance is around 1.19000, and any convincing breach above will take to the next level 1.1940/1.200/1.2040. The pair's near-term support is around 1.1860, break below targets 1.1840/1.1800.

Indicator (4-hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.1895-98 with SL around 1.1940 for the TP of 1.1800.