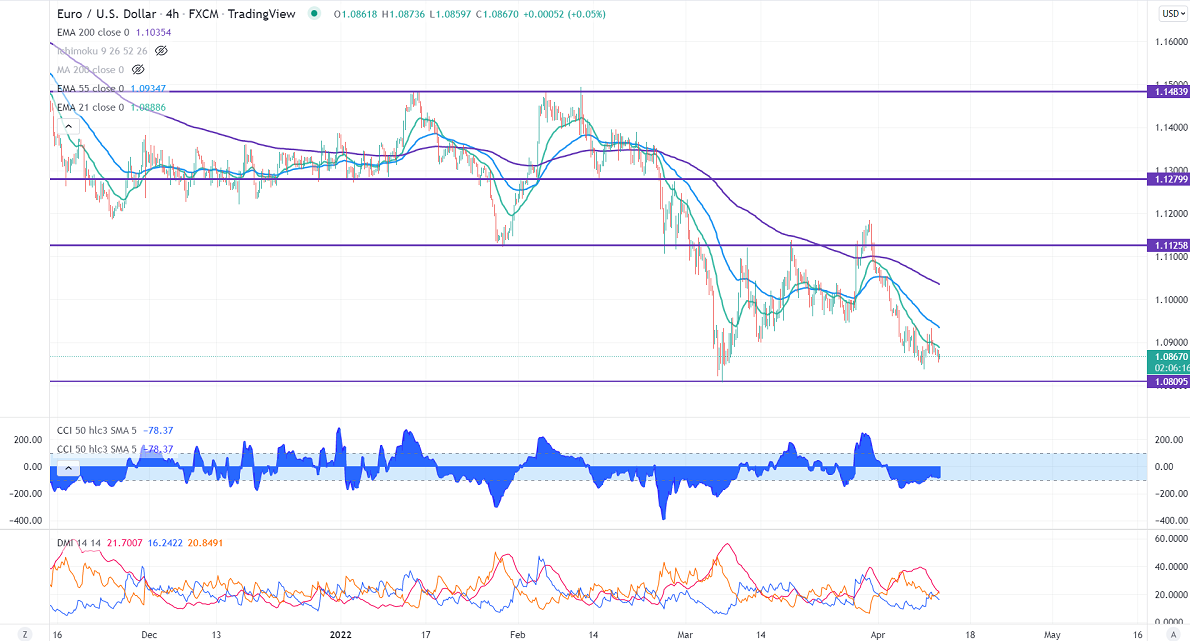

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.08924

Kijun-Sen- 1.08874

EURUSD faces bearish pressure on hawkish Fed comments. The board-based US Dollar buying due to surge in US treasury yield. The 10-year yield jumped and hits the highest level in 3 years. Markets eye US CPI data for further direction. German ZEW sentiment index dropped to -41.40 in Apr vs. an estimate of -48. EURUSD hits an intraday low of 1.08532 and is currently trading around 1.08710.

Technical:

On the higher side, near-term resistance is around 1.0950 and any convincing breach above will drag the pair to the next level 1.100/1.1050.

The pair's immediate support is at 1.0800, breaking below targets of 1.0730/1.0600.

Indicator (4-hour chart)

Directional movement index – Neutral

It is good to sell on rallies around 1.090 with SL around 1.0950 for a TP of 1.0800.