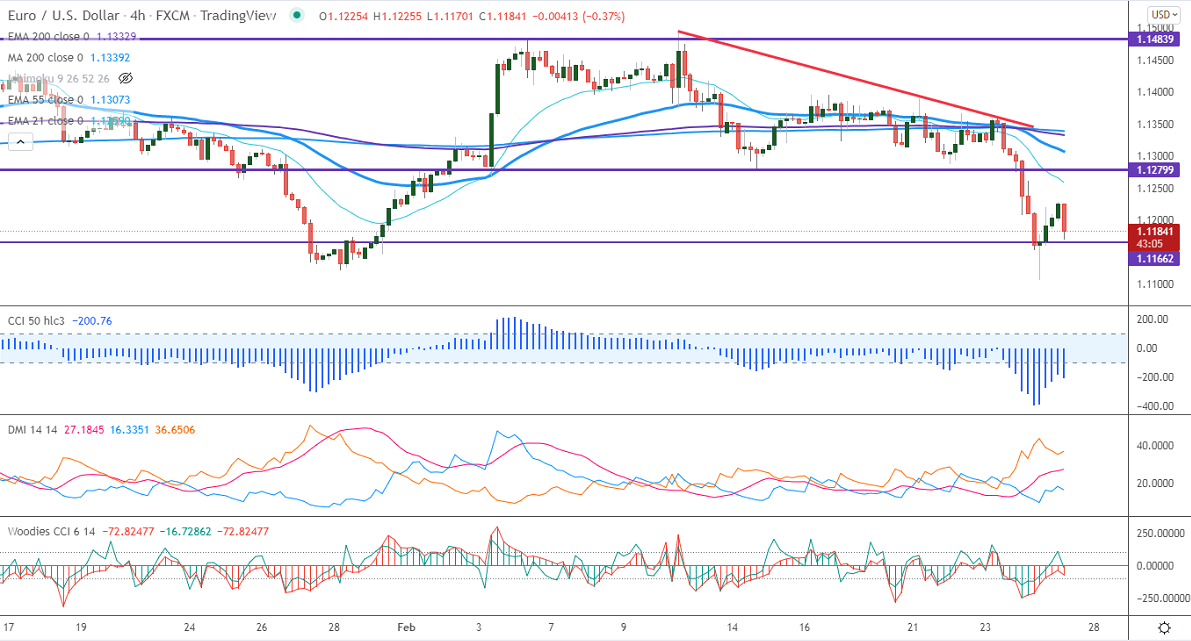

Intraday trend – Bearish

Major intraday support– 1.1280

The pair lost nearly 200 pips yesterday, the biggest daily loss in three months. The war between Russia and Ukraine has increased demand for Safe-haven assets like the US dollar. It hits a four-week low at 1.11063 and regained above 1.1200 on short covering. It is currently trading around 1.11780. The US 10-year yield pull-back caps further the upside of the pair.

The US grew by 7% in the fourth quarter in line with estimates, compared to 6.9% previous quarter. The number of people who have filed for unemployment benefits dropped to 232K this week vs. an estimate of 233K.

Technical-

Any breach below 1.1150 confirms intraday bearishness. A dip till 1.1100/1.080 is possible.

The immediate resistance to be watched is 1.1230; any violation above will take the pair to 1.1265/1.1300/1.1400.

Indicators (4-hour)

Directional movement index –Bearish

CCI (50) – Bearish

It is good to sell on rallies around 1.1228-30 with SL around 1.1265 for a TP of 1.1150.