JPM Commodities research has raised their oil forecasts for 2018 based on better-than-anticipated compliance to supply quotas, the likelihood of the OPEC/NOPEC production cut accord being extended through 2018, and a solid rise in global oil demand next year.

As a positive current account oil exporter, RUB is the cleanest FX beneficiary of a bullish shift in oil prices and has added tailwinds of high rate carry and cleaner positions/cheaper valuations than earlier in the year that prompted our EMEA team to turn OW last month.

We like expressing leveraged bullish RUB views via EURRUB instead of USDRUB for three reasons:

a) The better insulation to higher Treasury yields / stronger dollar;

b) the dovish tinge to the October ECB may have trimmed upside risks to the Euro, and Italian elections next year could potentially even generate some alpha on short EUR crosses in 1H’18 by refocusing investor attention on European sovereign risks; and

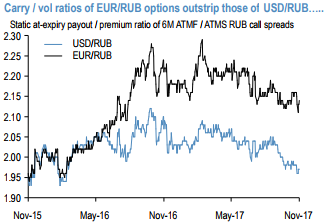

c) The carry/vol ratios of EURRUB options significantly outstrip those in USDRUB (refer above chart).

RUB call spreads / at-expiry digitals are ideal formats to express leveraged views in given the weight of existing positions that is likely to sponsor a low volatility grind higher in the currency.

In addition, RUB risk reversals have been chronic underperformers this year, which is likely to continue in an environment of contained volatility and potentially stronger oil prices than we are budgeting for (hence outperformance of RUB calls on skews), so there is value in net earning premium by selling RUB puts for financing purposes even with highly asymmetric strike selections (refer above chart).

For instance, 6M 67 strike (1%OTMS) EUR put/RUB call at expiry digitals can be purchased vs. selling 6M 72 strike EUR call/RUB put at expiry digitals (6.4% OTMS, above 1-yr spot highs) @ - 6.2% / -4.2% (i.e. net premium intake) of equal EUR notional/leg (forward ref. 70.49).

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge