The EUR is modestly higher on the day alongside the relatively broad market movement against the USD and following yesterday’s trend-breaking drop for the common currency. It follows market tone after modest losses yesterday. Nov business confidence numbers in France were mostly looked through by markets, with manufacturing confidence in France rising slightly to its highest point since Aug, although Brexit and trade uncertainty maintain activity in the sector significantly depressed around Europe. France’s Markit manufacturing PMI gauge remains slightly within expansionary territory but the protests against pension reform which erupted in early-Dec may prevent a prompt recovery for the French economy as was hoped for on the back of easing trade and Brexit risks.

ECB Chief Economist Philip Lane will chair a panel at an ECB conference on fiscal policy and EMU governance.

Trade recommendation:

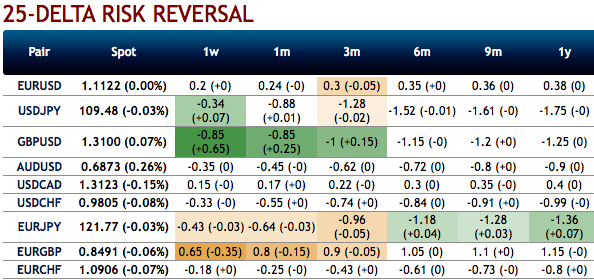

Stay long EURUSD digital call: EURUSD flashes positive risk reversal numbers that indicates the hedging sentiments for the upside risks.

Prices for levered versions of call spreads have recently been the lowest in five years due to record low base vols and positive risk reversals. So while the timing for European reflation trades is not ideal absent better data, this is partly offset by attractive cost considerations. The strong Conservative majority provides some support to EUR as well, and we keep an eye on momentum above 1.12. Broad-dollar selling into 1Q should further support the trade.

Hence, add long in a 4M 1.15 digital EUR call/USD put for 11.5% (spot ref 1.1113). Marked at 16.7%. Courtesy: JPM, Saxo & Scotiabank

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential