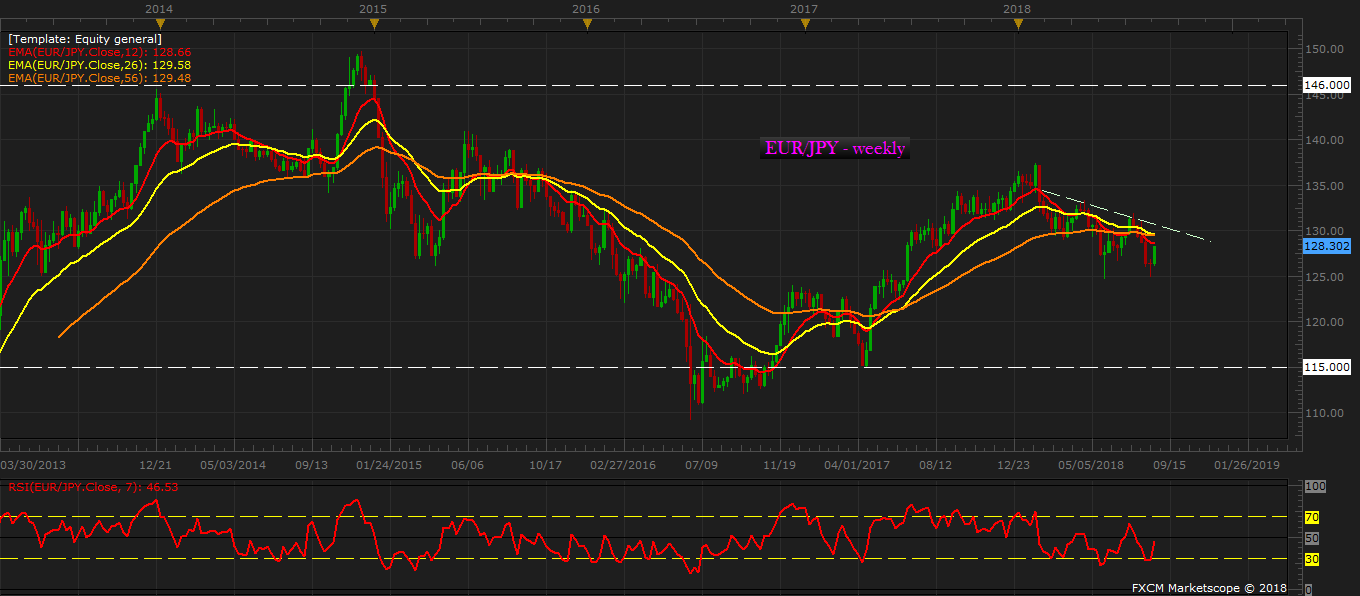

With both European Central Bank (ECB) and Bank of Japan (BoJ) continue their easing policy, the exchange rate is trapped in Bull/Bear fight. While the European Central Bank’s decision to wind up asset purchases by the end of the year is energizing the euro bulls; the Japanese yen is benefiting from risk aversion stemming from the impact of U.S. policies such as the trade disputes, higher interest rates, and others.

Our latest calculations at FxWirePro suggest that it might remain that way for some time further and the pair would consolidate. The euro bulls are targeting as high as 146 against the yen, while the yen bulls are targeting 115 per euro. The yen is currently trading at 128.3 per euro.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022