Politics again acted as the catalyst to sell euros. Last week was the German elections, and this week it is the escalating crisis in Catalonia. The German coalition government talks are expected to drag on for some time. The violence that attended the “symbolic” Catalan referendum and a potential declaration of independence in its wake have raised political tensions in Spain.

Over in the UK, embattled Theresa May came under additional fire as Tory party divisions over Brexit reopened. The cabinet infighting over the future UK-EU relationship is buoying EURGBP in the face of the euro correction. The bone of contention is whether the UK should seek regulatory convergence with the EU in order to secure a close trading relationship after Brexit.

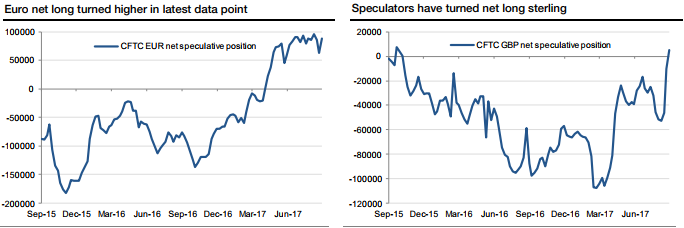

Away from politics, the latest CFTC data show that speculative positioning in euros and pounds rose as of a week ago while dropping further in dollars. So the positioning data suggest that we are still a long way from any meaningful correction in the bearish positioning against USD in the main European currencies (refer above charts).

The sole G10 central bank policy meeting this week is by the RBA, and there is a strong consensus call of no change to policy. The set of UK PMIs this week will be an important factor in shaping market expectations of BoE policy, as will the US ISM and employment data releases for Fed policy.

The list of key market events this week includes:

Oct 04: France-Germany-EA services PMI, UK services PMI, US ADP employment report, and US non-manufacturing ISM.

Oct 05: Switzerland CPI, ECB minutes, US factory orders, and US durable goods orders.

Oct 06: Germany factory orders, Canada employment report, and US employment report.

We are still anticipating a deeper correction in EURUSD, amid a bigger dollar bounce. The market-implied probability of a December Fed hike is still too low.

G10 vols fell and EM vols rose during this week’s dollar shakeout, but decoupling is unlikely to sustain. Asian FX (INR, IDR, KRW) vols are most susceptible to mean-reversion lower in EM, while GBP-vols look cheap in G10; buy GBPCHF EURCHF vol spreads. USDCHF stands out as decay positive candidate to buy USD calls in on risk-reversals. Buy USDCHF vs. USDSGD risk-reversal spreads to earn the dollar-neutral skew risk premium. Benchmarking ZAR, MXN and BRL vol curves to historical precedents of election event risk pricing suggests that MXN risk premia are rich.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential