The purchasing managers' indices for the euro zone in October were visibly disappointing. The index for the manufacturing sector dipped by 1.1 points to 52.1. This is the lowest value since May 2016. The index for the services sector also fell by 1.4 points to 53.3, a new year low. This lowers the hope that the weak economic growth in the summer - economic growth is expected of only 0.2% in the third quarter compared with the second quarter - is only an outlier.

The ECB’s policy outlook tomorrow and EUR crosses are unlikely to be much moved from such outturns.

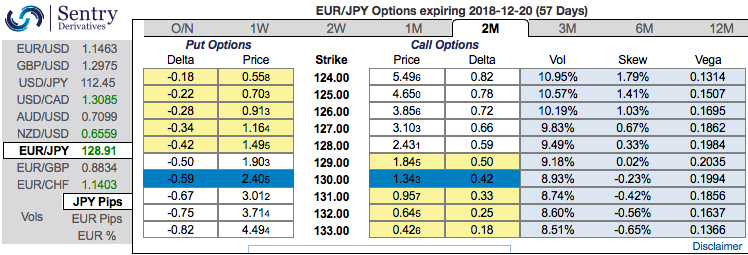

EURJPY IV skewness: Please be noted that the positively skewed implied volatility (IVs) of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money. The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Risk reversals: Most importantly, to substantiate the above indications, rising negative risk reversal numbers of EURJPY across all tenors are also substantiating bearish risks in the long run. While shrinking IVs that are on lower side, is interpreted as conducive for put option writers.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. While the OTC volume index exhibits volume traded in the last 24-hours versus a rolling one month daily average, and euro options are buzzing on above-stated news flows (especially, EURJPY contracts are the highest volumes to trade). Without capturing all OTC flow, the index is a barometer of volume on liquid contracts for different crosses. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -102 levels (which is bearish), hourly JPY spot index was at 94 (bullish) while articulating at (09:26 GMT). For more details on the index, please refer below weblink:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge