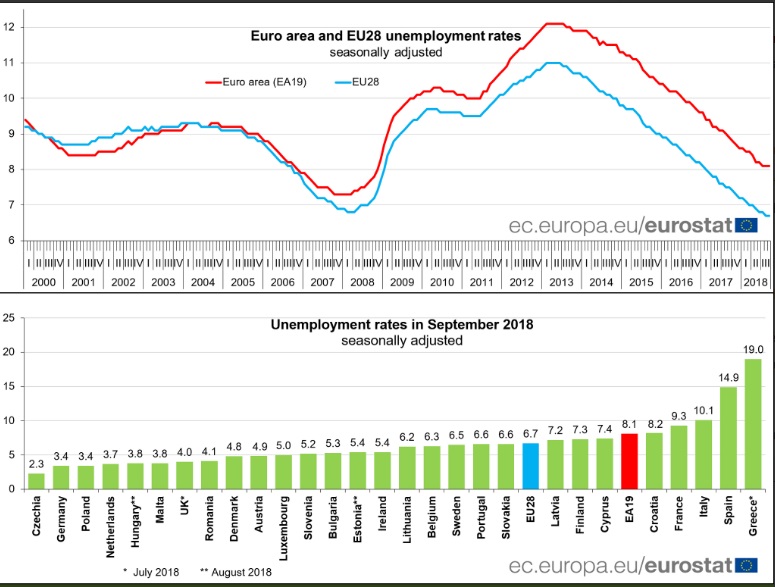

Euro Zone, as well as the European Union, has been facing one of the most diverse economic and Labour market recoveries in the history. Partial reforms pursued by governments coupled with the ultra-easy monetary policy from European Central Bank (ECB) have led to the rise in employment across the Euro Zone, however, it is still above any level that can be called as normal. The latest employment number shows that unemployment rate at 8.1 percent, which is the lowest reading since the ‘Great Recession’ of 2008/09, but still highest among developed markets.

As of now, inflation remains weak with partial thanks to a stronger euro despite relatively higher oil and other commodities price, however, if inflation does return before fragmentation in the labor market is removed, the ECB would face critical policy choices, whether to raise rates to prevent any overheating of stronger economies with lower unemployment rate or to keep easing to bolster growth across the weaker ones like Greece, Spain, and Cyprus. The latest employment number shows that the unemployment rate at 8.1 percent in September. However, outlier countries continue to pose concerns.

European Central Banks (ECB) and the governments need to coordinate together to pursue reforms in such a way that economic recoveries converge and fragmentation gets reduced.

As of latest employment report outliers are still high, despite improvement in the overall labor market –

- Euro area unemployment rate is at 8.1 percent as of September 2018. However, a lot is still to be done as almost 8.5 million still remains unemployed in the Euro area.

- Fragmentation is quite large. While Germany, enjoys the lowest unemployment rates in the region at 3.4 percent, Greece and Spain have their rates at 19 percent and at 16.1 percent.

- Even in France, almost one person in eleven is unemployed with the unemployment rate at 9.3 percent.

- Euro area’s third-largest economy, Italy is suffering unemployment as high as 10.1 percent and the improvements have been lower than Spain.

- Eight Eurozone countries are suffering higher unemployment rate than the EU average of 7.1 percent.

In recent weeks, ECB has signaled a reversal of monetary policies by winding up the asset purchase program by this year but has been struggling with its monetary policies; record easing and negative rates, still not pushing inflation higher. It’s time the governments to do more to boost employment.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX