Currency Derivatives Insights: (EURJPY)

Hedge this pair's potential slumps through deploying option strategy (Put Ratio back Spread) as weekly technical charts suggest bearish bias.

%D line crossover above 80 levels on slow stochastic signals overbought pressures, (%D line at 80.4484 & %K line at 71.4384). RSI (1) also indicates downward convergence with falling prices, (RSI trending at 51.9610).

Gap down opening has happened this week with abundant volumes to confirm weakness in this pair however, it managed to fill in this gap with euro sessions left over. We traced a spinning top pattern candle formation also at peak around 138.95 levels again with the volume confirmation.

As we expect the underlying currency (EURJPY) to make a large move on the downside in medium term.

Purchase puts and sell fewer puts of a higher strike (ITM) usually in a ratio of 2:1.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

The underlying exchange rate has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike.

Give it a longer time to expiration so as to make a substantial move on the downside.

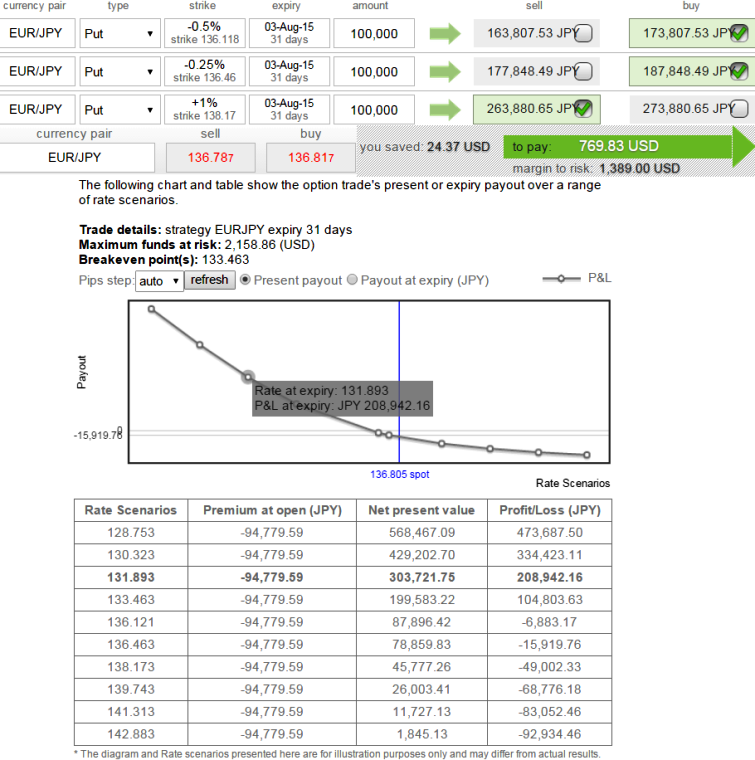

We recommend purchasing 30D (-0.25%) OTM -0.46 delta put (strike at 136.485) and one more 30D (-0.5%) deeper Out-Of-The-Money -0.43 delta put (strike at 136.143) and simultaneously short 30D (1%) ITM put (strike at 138.194).

As we can make out in the diagram, The ITM strike short put finances long sides and the position is entered for no cost or at a very negligible cost as shown in the figure (for a net credit at JPY 263,880.65). However, margins are required to short ITM puts.

The underlying exchange rate of Yen has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike.

We've given this strategy a longer time for expiration (30D) so as to make a substantial move on the downside.

FxWirePro: Expect downtrend in EUR/JPY; Mitigate downside risks via PRBS

Friday, July 3, 2015 8:33 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary