Following the Fed minutes last week, the low signal-to-noise ratio delivered from Washington, and the latest global cyclical data, we see fewer catalysts that would push LatAm currencies weaker versus the USD over the coming month. We have been cautious on LatAm FX following the US election, holding mostly shorts in the JPM’s GBI-EM Model Portfolio, and recently that strategy has not been working.

Comments from US Treasury Secretary Mnuchin that action against Mexican trade is not expected in the short-term and that any decision around China’s currency would not occur before April’s Treasury report further point to this lack of immediate negative catalysts for EM FX in the region. This could leave a continuation of the pro-carry environment, as two factors suggest that FX carry strategies may have further legs:

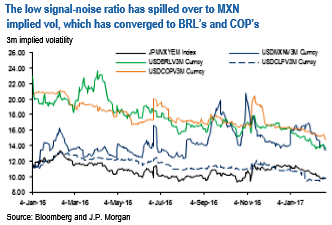

1) The lack of momentum in the USD index coupled with declining implied volatility (see above chart) and,

2) The short speculative positioning in US Treasury market looks heavy (refer above chart).

Recent policy moves in Mexico to relieve pressure on the currency are helping this trend and we now see less attractive risk-reward in holding on to JPM’s UW MXN and CLP positions and move both to neutral in GBI-EM Model Portfolio. Regarding MXN, the break of the key 20.20 USDMXN level following the announcement of a new swap facility has opened a channel to reach 19.5.

Moreover, the implied volatility collapse also bodes well for the currency in the near term (see above chart).

In the medium term, we expect the MXN to weaken again, as we see currency gains limited given fundamental uncertainty and deteriorating cyclicals. Given the near-term risk is for further USDMXN consolidation, we see less short-term upside in holding a short position in the portfolio given that we are neutral rates in Mexico.

We hold to the idea that MXN gains are limited in the medium term due to fundamental uncertainty and deteriorating cyclicals. The NAFTA renegotiation is already defined to transpire in a bilateral way, and is likely to be a protracted one.

Moreover, other institutional arrangements could be revamped (e.g. border security). While postponing these negotiations could be near term MXN positive, we believe delays could end up bumping into the political cycle in Mexico.

As we have flagged, our bearish medium-term MXN outlook stems largely from potential protectionist measures by the US, but not exclusively, as credit rating risks and domestic political risks also loom large in the coming year. Potential protectionist trade/tax measures would have several implications, from lower growth (not only this year but also medium term growth) to external accounts.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings