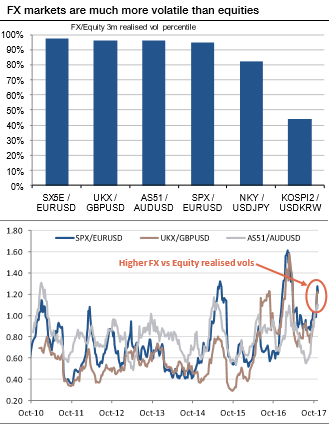

There continues to be wide gulf between the European and US equity markets in terms of liquidity and gap between FX volatility. Not only are the cash markets much deeper in terms of daily turnover, but the derivative markets are also dominated by different drivers altogether. The reflections of structured products on volatility, skew, and dividends in Europe is much more pronounced compared to the US which has a much deeper flow market.

The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock built. It has been one of the few assets on which carrying long volatility positions has not been a constant pain. It has also led to a dramatic reversal in the correlation regime, leading to some significant discounts on equity options contingent to currency levels.

We believe there is an elephant in the room that market participants are struggling to see, despite it having huge implications for equity markets. It is the EURUSD impact on US and Eurozone equities.

Traditionally, a stronger euro is said to be a drag for Eurozone equities, and in particular core country indexes (e.g. DAX and CAC), and symmetrically a stronger dollar is said to be a drag for US exporters and hence US equities. But the US and Eurozone equities are also strongly positively correlated.

How can this correlation matrix work? In fact, it is the relative performance between US and Eurozone equities that is generally driven by the EURUSD rather than the outright equity performance. Hence a higher euro, despite being negatively correlated with US equity (in a log return correlation), can still coincide with higher US equities.

Cable is trading very flat for the past one week, while While Britain's FTSE 100 trades up about 0.27 pct at 7,545.48 points on bouncing back after heavy losses in the previous session due to resurfacing political worries.

The UK and EU have reached the deal for the first phase on Friday and next phase on trade negotiations is expected to happen next week. The pair has recovered almost 100 pips from the low of 1.33029 made on Dec 15th 2017 and is currently trading around 1.3380.

Elsewhere, AS51 down by 0.25% to trade at 6060.35, while AUD nudged higher from 0.7660 to 0.7679, as did NZD from 0.6960 to 0.6988. AUDNZD initially rose to 1.1013 – a two-week high – before retracing to 1.0980. The equity benchmark Down Under dropped below the point at which it started 2017 after North Korea fired a missile over Japan and the fallout from scandals surrounding Australia’s biggest bank weighed on major financial stocks. Courtesy: SG

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary