China’s trade data look fine, as both exports and imports rose at a double-digit pace. After seasonal adjustment, trade data in June also saw some sort of improvement.

In the meantime, China runs a huge trade surplus, which is always criticized by the US government.

China's trade surplus fell to USD 42.77 billion in June of 2017 from USD 45.16 billion a year earlier while market expected a USD 42.44 billion surplus, as exports rose less than imports. Year-on-year, sales grew by 11.3 pct to USD 196.6 billion, faster than a 8.7 pct rise in the prior month and beating estimates of a 8.7 pct growth. Purchases jumped 17.2 pct to USD 153.8 billion, compared to a 14.8 pct increase in a month earlier and above consensus of a 13.1 pct rise.

Last week, the Caixin Manufacturing PMI in China unexpectedly rose to 50.4 in June of 2017 from 49.6 in May and beating market consensus of 49.5. It was the highest reading since March, as output and new export orders increased at a faster pace. Also, buying activity rose slightly.

However, the stability in CNY is not because of huge trade surplus, but capital controls. The outward investment data which were also released this morning illustrated a 48% drop in the first half of this year, as the authorities have significantly tightened the quota on outward investment.

That said, as long as China still controls the capital outflows, we can’t see the complete picture of CNY exchange rate.

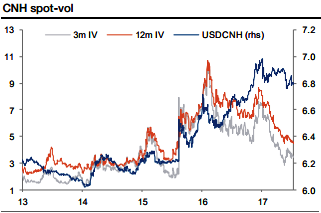

Implied volatility has fallen sharply in 2017 alongside the rally in EM currencies, but in some cases such as CNH and TRY the decline in volatility has been larger than normal for the magnitude of the move in spot rates.

We believe downside optionality offers the best value and vol would go lower with the spot. A USDCNH 3m put strike 6.75 RKO 6.60 costs around 0.18% (vanilla is about 0.36%) and covers the period preceding the leadership changes in 4Q.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data