After US and Swedish CPI prints this week, we reiterate their market-moving potential. Consumer prices in the United States increased 2.2% YoY in February of 2018, slightly above 2.1% in January and in line with market expectations. The monthly rate eased to 0.2% from 0.5%, also matching forecasts. Prices rose for shelter, apparel, and motor vehicle insurance while food index was unchanged and energy increased only slightly.

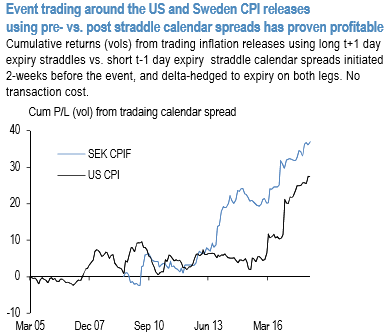

Our research has established that a strategy of capturing event-driven surprises via pre-/post-calendar spreads in options (selling pre-event options and buying post-event options in order to isolate and capture sharp spot moves/realized volatility) has proven to be profitable for G10 inflation releases in general and the US and Sweden CPI in particular (refer 1st chart).

Nevertheless, following the surprise hourly earnings print in early February and the firm US CPI print the following week, markets seemingly got preoccupied with trade-related developments. Break-evens for the March 13th CPI print at around 0.4% for the broad USD index is well below the last month 0.6-0.7% CPI break-evens. On average, overnight vols for next week's CPI release are more than 2.5vols lower than during the Feb cycle.

Consensus exceptions are for a contained 0.2% m/m print, but an upside surprise cannot be ruled out since inflation forecast errors tend to be serially correlated and directional with actual inflation and may yet again intensify speculations for a quicker Fed if realized. The 2nd chart shows a 2x2 grid for CPI O/N vol valuation. X-axis: pricing of the current CPI print relative to historical CPI pricing and 2) y-axis: an analog of realized /implied vol.

The takeaway is that AUD and NZD are the best places to position for an inflation surprise. This is a comforting conclusion since our studies show that smaller currencies like AUD and CAD that are not always the options markets’ prime focus for accurate event risk premium pricing of US inflation prints deliver better returns than more closely watched vol surfaces in majors such as EUR or JPY. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures