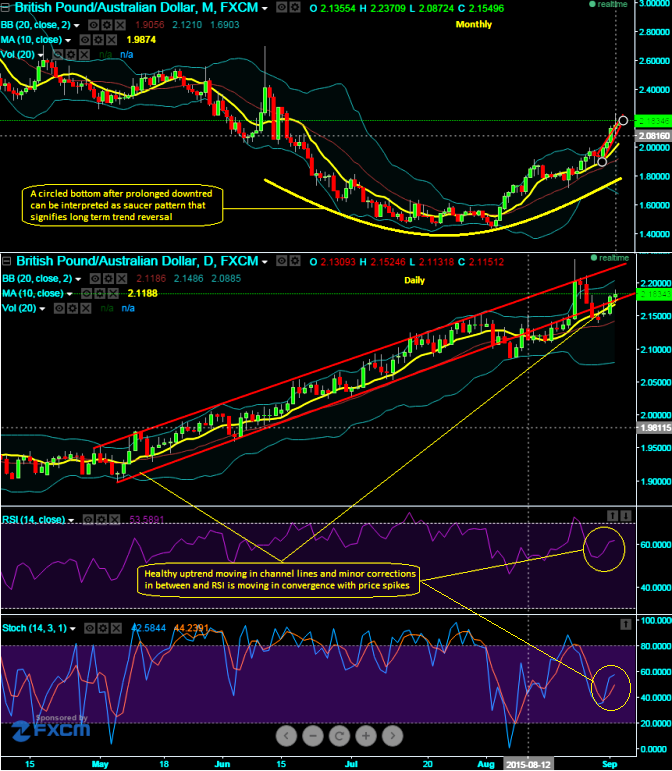

Technical Glance:

It is a clear rounding bottom considering previous downtrend on daily charts of GBPAUD, hence saucer pattern to prolong in long run which should evidence a long term uptrend. While we were designing long term hedging framework 14 week RSI was used with an objective to track price momentum over medium to long term perspectives. Despite the strength index curve approached 80 levels (i.e. overbought territory) it was moving in convergence with rising prices. For a swing trader it is all too easy to be carried away by a market that apparently knows no bounds. While slow stochastic on the other hand has remained in overbought territory and it is signifying slight indecision but there is no harm for strength in current prices.

Currency Option Strategy:

We now want to square off the positions in strips, book the profits and for now convert the same into strap on hedging grounds. Unlike spreads, combinations allow adding both calls and puts at a time in our strategy. So, buy 15D At The Money -0.49 delta put option and simultaneously short 2 lots of 15D At The Money 0.51 delta call options. It involves buying a number of ATM puts and double the number of calls. The strap is more of customized version combination and more bullish version of the common straddle.

Hence, any hedger or trader who believes the underlying currency is more likely to surge upside can go for this strategy. Maximum returns can be achievable when the underlying exchange rate makes a strong move either upwards or downwards at expiration but with greater gains to be made with an upward move. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

FxWirePro: GBP/AUD healthy uptrend to resume after minor correction; option straps for hedging perspectives

Wednesday, September 2, 2015 9:38 AM UTC

Editor's Picks

- Market Data

Most Popular