Aussie retail sales prints again disappointed, with sales in June rising by just 0.1% MoM despite a bounce-back in clothing sales. Retail sales fell in both NSW and Victoria. Interestingly, the weakness is concentrated in sales by small retailers. In real terms, retail sales rose by 0.4% in Q2 while retail price inflation remained muted.

But GBPAUD doesn't seem to have discounted, the pair has been stagnantly trading at 1.7496 levels awaiting for BOE rate decision.

Today’s data highlight some underlying fragility in the economy and reinforce the appropriateness of ultra-easy monetary policy settings. On the contrary, the trade balance in U.K. has expanded from previous -9.9B to the current -10.3B in line with the forecasts.

The FX market has priced that in and any extreme or dramatic weakness in GBP as a result of today’s cut is unlikely but bears are likely to drag further is a certain event.

Instead what will be decisive for the GBP exchange rates will be whether the BoE implements further measures. Some BoE officials had already signalled that they would support further measures. It is therefore hardly surprising that approx. half of analysts polled by Bloomberg expect the bond purchasing programme to be re-activated today.

With resultant effects, the GBPAUD cross is anticipated to depreciate further, most likely towards 1.7025 levels.

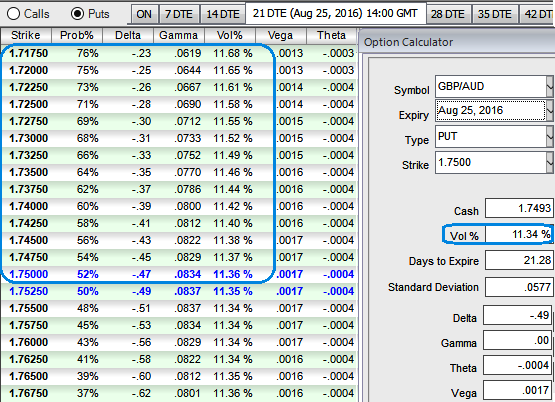

BoE's rate decision would be released which is likely to add pressures on sterling but the potential risks of post-Brexit event keeps adding more pressures, in addition to this refer above diagram for IVs and sensitivity marks in FX options due to the U.K's interest rate speculations, OTM put strikes are on competitive advantage.

Historically, the pair has been very well reacting as per earlier analysis and we maintain our next bearish targets at 1.7025 levels.

Since OTC markets seem to be highly volatile with an extremely bearish environment, and IVs for 1M contracts are expected to fade away (at around 11% and above). This would be a good news for option holders contemplating the prevailing bearish environment but more number of longs in ATM delta puts would ensure the reasonable probabilities in underlying exposures.

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

So, here goes the strategy this way, Go long in 2 lots 1M ATM -0.50 delta puts, long in 2M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 3:1with net delta at around -0.70.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close